Article Contents

Medicaid, jointly funded by the federal government and states, is a state-run healthcare program that provides coverage to low-income Americans at all phases of their lives. In 2020, healthcare costs in the United States climbed by 10%, with an average of $11,945 spent per person. And in the same year, Medicaid spent $671.2 billion, which is 16% of total NHE. Because the expense of assisted living and nursing facility care is so high, ranging from $51,600 to $93,075 per year, many seniors rely on government programs like Medicaid to help pay for medical bills, personal care, and other services.

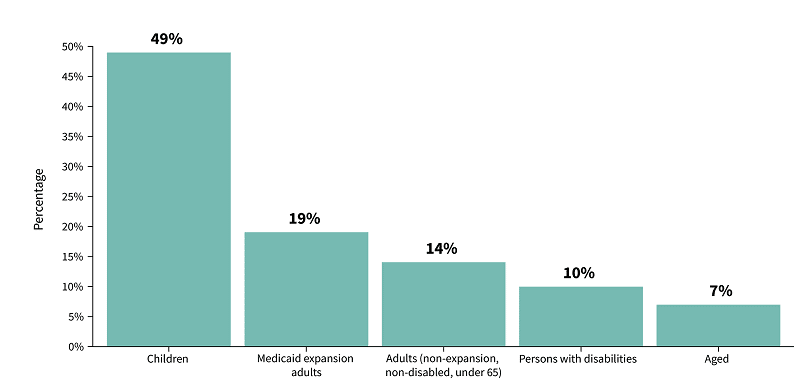

Medicaid has insured more than 85 million Americans from birth to age 65 and beyond by November 2021. According to the Center for Medicaid and CHIP, nearly 39 million Medicaid enrollees were children as of April 2021. Among the total enrollees, adults over 65 held 7%, while 10% and 49% were disabled adults and children (2020 analysis). All these show that the majority of the Medicaid participants in the USA are vulnerable groups of children, senior adults, and disabled people.

Share of Medicaid & CHIP Population by Eligibility Group

In this guide, we will help you understand the program, learn about eligibility requirements, and discover what’s covered. We’ll go over the Medicaid benefits available for senior care at home, in assisted living communities, and skilled nursing facilities. We will also share how to apply for Medicaid services on your own or with the assistance of a Medicaid planner.

What is Medicaid? Understanding the Basics

Medicaid provides a wide range of medical and non-medical support services to seniors who are eligible for the program. Nursing home care is also provided via the state plan. As a result, Medicaid may cover virtually all of a senior’s long-term care costs if he or she is financially and medically eligible.

Medicaid programs must adhere to federal regulations. The federal government contributes a share of the expenditures, but each state manages Medicaid independently. As a result, coverage and expenses may vary depending on your state’s demands and economic goals. One of the most perplexing aspects of this system is that most states offer several programs aimed at different groups of people. In California, for example, Medicaid is known as Medi-Cal. And the waiver program that pays for assisted living services is called ALW.

In addition to the regular Medicaid, there are also special and different poverty-level programs for the Aged, Blind or Disabled people. In this guide, we’ll focus on institutional Medicaid, which is one of the more relevant programs for older persons.

Institutional Medicaid is a significant source of funding for long-term care. This program covers more than 60% of nursing home residents in the United States. Furthermore, Medicaid covers more than half of all long-term care claims in the United States, making it an essential part of the federal budget and the healthcare industry, and the economy.

How Does Medicaid Work?

There are no premiums or deductibles in most cases because Medicaid is for people with insufficient resources and/or substantial medical needs. On the other hand, some states have share-of-cost requirements based on your income. You’ll have access to primary and emergency medical care, as well as long-term services and support, once your coverage is in place. Medicaid is administered by the government in certain states, while private insurers run managed care organizations in others. If you’ve had other types of insurance, you’ll be familiar with the Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) networks that come with this sort of coverage.

One of the benefits of Medicaid is that if you’re a dual enrollee, it may cover your Medicare co-pays or coinsurance, as well as any expenditures that your primary insurance doesn’t cover. For instance, Medicaid can help with out-of-pocket medical expenses for Medicare enrollees with limited income. Additionally, Medicaid covers a few services that are not covered by Medicare benefits, including Skilled Nursing Home payments beyond the 100-day limit. Yet, the services will first go under Medicare eligibility and then will be covered by Medicaid if Medicare benefits don’t apply.

Benefits of Medicaid Coverage

Medicaid covers some mandatory medical services as well as some supplementary benefits that vary by state. Both benefit coverage alternatives are excellent for low-income families that find medical care prohibitively expensive.

Mandatory Medicaid benefits

Medicaid services that are mandatory can be quite similar to those provided by Original Medicare Parts A and B. The following are some of them:

- Hospital care

- Skilled nursing

- In-home care

- Preventive care

- Wellness screenings

- Doctor’s visits

- Diagnostics

- Transportation to medical care

- EPSDT: Early and Periodic Screening, Diagnostic, and Treatment Services

- Mental Health personal care services

Additional Medicaid benefits

Below are optional coverages that vary from state to state:

- Prescription Drugs

- Clinic services

- Physical therapy

- Occupational therapy

- Speech, hearing, and language disorder services

- Respiratory care long-term services

- Other diagnostic, screening, preventive, and rehabilitative services

- Podiatry services

- Optometry services

- Dental Plans

- Hospice

3 Types of Medicaid Programs

Senior Medicaid programs can be one of the most complicated ones which are not appropriately understood. In addition, the state government has different qualification requirements that narrow down or sometimes expand the program’s eligibility. Here are three specific Medicaid programs that you should be aware of.

1. Institutional Medicaid

As institutional benefits, Medicaid pays for some inpatient, comprehensive services. The term “institutional services” refers to a set of benefits covered under the Social Security Act. Hospital services, Skilled Nursing Facilities (SNFs), Intermediate Care Facilities for People with Intellectual Disabilities (ICF/ID), and Services for Individuals 65 and older in a mental health facility are all included.

2. Medicaid Waivers

Medicaid waivers are an important tool for states to provide community-based long-term care services and supports to individuals with disabilities and elders. Waivers allow states flexibility in how they deliver Medicaid-funded long-term care services, while still meeting federal requirements.

Home and community-based services (HCBS) waivers are the most common type of Medicaid waiver, and they allow states to provide Medicaid-funded long-term care services in home and community settings rather than in institutions. HCBS waivers can include a wide range of services, such as personal care, home health care, case management, and respite care.

Although state Medicaid programs must pay for long-term services and supports in SNF, waivers are optional for them. So, eligibility requirements and scope of benefits may vary across states. In addition, as they are not entitlement programs, seniors often have to experience long waiting times. The national average waiting time can be as long as 39 months.

3. Cash and Counselling

The Cash and Counseling Program is a federally-funded program that provides cash payments to Medicare beneficiaries who need personal care services. The program is designed to give beneficiaries more control over their care by allowing them to choose their own providers and receive payment for services rendered. In many consumer-directed programs, family members can be “designated” as care providers and be paid for it. This implies they can be compensated for providing personal assistance to a loved one. Even spouses can be employed and compensated to provide care.

Things that Medicaid Does Not Cover

Although Medicaid will pay for some services that Medicare doesn’t cover, there are some limitations to the program’s coverage. For example, except in specific travel-related conditions or where a foreign hospital is closer than domestic alternatives, Medicaid will not pay for medical care received outside of the United States. Furthermore, Medicaid does not cover:

- Replacing medical equipment through warranty

- Healthcare services provided by other government agencies

- Providing free healthcare screening devices

- Cosmetic surgery

- Personal items

Most items that aren’t covered fall into one of three categories

- Medically unnecessary and unreasonable services

- Improper bundling of charges

- Reimbursement from another program

A few disadvantages of Medicaid

Along with the list of services that Medicaid does not cover, there are some more disadvantages you might face with the benefit. They may include:

The eligibility criteria differ from one state to another. So, you may be eligible for Medicaid benefits in one state, but in another state, you might not qualify. As a result, it is crucial to know your state’s requirements before applying for these benefits.

The Medicaid benefits do not stay the same for a lifetime. Thus, you might find the benefits changing from year to year. So, you will have to keep an eye on the benefits offered from time to time. It has also been found that the quality of care through Medicaid benefits can differ from time to time.

How do I qualify for Medicaid? Eligibility requirements

To qualify for many Medicaid benefits, seniors must be financially limited as well as have a medical need for it. In addition, there are different eligibility requirements for different states, Medicaid programs or waivers, and age groups. As a result, there are hundreds of distinct sets of Medicaid long-term care eligibility regulations across the United States. Having said that, we’ve created a list of general guidelines that apply to most seniors.

Financial eligibility

Each state evaluates an individual’s resources differently for deciding Medicaid long-term care eligibility. However, income and assets are considered essential criteria for older applicants and have qualification limitations. The Medicaid program is a safety net for low-income people, but even with an income or assets above the limits, it’s possible to qualify with proper planning.

Income Limit

For Institutional Medicaid, most states have embraced the optional Special Income Level criterion. To be eligible for the special income level group, individuals must require continuous institutional care (hospital and/or Skilled Nursing facility care) for at least 30 days. And they can earn up to 300 percent of the SSI Federal Benefit Rate under this income rule. This is a very hard restriction cap. States may establish less income standards to apply less restrictive methodologies if the gross income does not exceed the monthly cap. The monthly cap for 2021 is $2,382, and it usually doubles for married couples.

Asset limit and exemptions

The financial resources of Medicaid applicants are also crucial in determining their eligibility. “Assets” and “countable assets” are other terms for resources. For the long-term care Medicaid program, the countable asset limit for a single senior in most states is $2,000. And for a married couple, the limit is generally $3000. But if only one spouse is applying for this benefit, then the other community spouse (non-applicant spouse) can keep up to $137,4000. There are many exceptions when it comes to establishing what counts as “countable.” The applicant’s primary residence, automobile, jewelry, clothing, and furniture, for example, are all “non-countable” or excluded assets.

A senior is regarded to be in the “Medicaid Gap” if his or her financial assets surpass the Medicaid eligibility limit. Still, their income does not meet long-term care costs. In this case, some seniors will “spend down” their assets on those care bills (pay for their own care) until they are eligible.

Non-financial eligibility

To be eligible for any Medicaid program, individuals must also meet some non-financial requirements. They must be USA citizens or lawful permanent residents. They also need to apply in their primary states of residency. However, unless they have a life-threatening emergency or are unable to receive critical care in their home states, out-of-state coverage is limited.

Institutional Medicaid only pays for skilled nursing if the patient requires it. As part of the application process, most states require seniors to complete a functional needs evaluation. It usually takes 45 minutes to an hour to complete this assessment. An assessor asks the applicant a series of state-approved questions to determine their functional needs, mobility, overall health, and need for assistance with daily activities. These responses are then assessed, and an overall rating is calculated.

In general, applicants must require assistance with at least two activities of daily living to qualify for Institutional Medicaid or Medicaid waivers. In addition, seniors must need nursing home level care to be eligible for the waivers. These waivers pay for long-term care services outside the nursing home setting. States may also consider the applicant’s medical history, as some diseases, such as Alzheimer’s and Parkinson’s, may compel the need for long-term care at a facility.

Common misperception on Medicaid qualification

Other qualifying considerations and criteria are frequently assumed to impact eligibility when a senior does not qualify for Medicaid benefits. For example, individuals 65 and older, or younger if they are formally disabled, are eligible for Medicaid long-term care services. Marital status indirectly impacts eligibility because it changes income and asset restrictions. However, the status of a veteran has no bearing on eligibility. Veterans may also be eligible for other types of help.

How to Check if you Qualify for Medicaid

You can only find out if you qualify for Medicaid by filling out an application. However, before you do, talk to a Certified Medicaid Planner (CMP) to ensure you’re on the right track. The CMP Governing Board is in charge of certifying CMPs. Attorneys, accountants, social workers, financial advisors, and geriatric care managers are among those that operate in this field. Medicaid is one of the government’s most complicated bureaucratic processes. Therefore, hiring a professional is a good idea, just like hiring an accountant to file your taxes or consulting a lawyer for legal advice.

How to Apply for Medicaid Benefits?

Seniors can apply for Medicaid in their own state by visiting their local Medicaid office and filling out an application. Alternatively, many states now enable applicants to apply online. First, fill out the health insurance application through the Health Insurance Marketplace, either electronically or on paper. The Health Insurance Marketplace will transmit your personal information to your state agency if anyone in your family is “eligible.” After that, your state agency will contact you about enrolling. Next, directly contact your state’s Medicaid agency. When you enter your state, the site will link you to the contact information for your state’s Medicaid agency.

CHIP can also be used as a substitute. Children whose parents do not qualify for Medicaid can be eligible for the Children’s Health Insurance Program (CHIP). States are in charge of administering CHIP, which the federal government mandates. States and the federal government both contribute to the program’s funding.

Medicaid application processing timeline

In most cases, Medicaid applications are handled within 45 days of receipt or 90 days if a disability assessment is required. However, in order to collect the necessary paperwork for the application process, a family needs to add several weeks to that estimate. It can be challenging to reapply for Medicaid in a different state, whether for oneself or a family member.

Medicaid Innovation Accelerator Program

The Medicaid Innovation Accelerator Program (IAP), a collaboration between the Center for Medicaid and CHIP Services (CMCS) and the Center for Medicare & Medicaid Innovation, was administered by the Centers for Medicare & Medicaid Services (CMS) from July 2014 until September 2020. (CMMI). IAP’s mission was to improve Medicaid beneficiaries’ health and care while also lowering costs by assisting states with ongoing payment and delivery system improvements. In addition, by providing focused technical assistance, tool creation, and cross-state learning opportunities, the Medicaid IAP assisted Medicaid agencies in strengthening capacity in the key program and functional areas.

Medicaid Planning Techniques

While applying for Medicaid may seem like a simple process, there are many factors that can cause complications. Most importantly, married couples have the option of applying jointly or separately and this affects their eligibility differently depending on which method they choose to use in relation with each other as well on how much income and assets an individual reports when filing his/her paperwork. Even though things like income and assets have specific definitions, they are open for interpretations as well. So, it’s important not only to report accurate information but also stay pays attention during every step that can help improve the chances of being accepted.

What is Medicaid Planning?

“Medicaid planning” is a term that refers to a variety of activities aimed at assisting people in obtaining Medicaid benefits. For example, a Medicaid planner can double-check a client’s Medicaid application before submitting it to ensure that it’s complete. Also, Medicaid planners can complete asset restructuring to assist seniors in becoming Medicaid-eligible.

How to get qualified for Medicaid when income exceeds the limit

Medicaid’s long-term care applicants’ income level must not exceed the allowable limits. The excess income can be directly allocated to a restricted funds account if it goes beyond that limit. They are referred to as Qualified Income Trusts (QIT) or Miller Trusts. These funds can be used only to pay for specified costs like medical bills, nursing home bills, and Medicare premiums. The total process is quite complicated. Therefore, consulting a Medicaid Planning professional about qualifying for this benefit is highly recommended.

As Medicaid qualifications vary from state to state, not all states allow these trusts. They ask to “spend-down” the excess monthly income on medical-related care to be approved.

How to get qualified for Medicaid when assets exceed the limit

It’s unusual for a Medicaid applicant’s total assets worth to be less than $2,000. Meeting this restriction frequently entails reorganizing one’s assets to make them non-countable assets and/or putting surplus assets into trusts. It may also require spending down the excess assets to meet the specified limit. 50 states accept this asset “spend down” option. But they have their own rule sets for deciding how the assets should be spent or reallocated.

While the non-income applicant is not considered in their spouse’s eligibility, the couple’s assets are regarded as jointly owned. So, the community spouse can keep only up to $137,400 worth of countable assets. To be eligible for Medicaid long term care benefit, the rest of the assets should be legally spent. The process requires great caution. Otherwise, Medicaid eligibility may be denied if the rule is violated. For example, one rule prohibits or restricts gifting.

Learn About Medicaid penalties

Medicaid has a look-back period of 60 months in general prior to the application date. It reviews applicants’ all types of asset transfers during this period of time. If any look-back rule is violated, a penalty period of Medicaid ineligibility will be established. It ensures that no assets were given away or sold for less than fair market value.

The penalty period usually begins when an applicant applies for Medicaid; it does not begin when a disqualifying transfer is done. In some states, the penalty period may start on the first day of the month after the denial of a Medicaid application. One can reapply for long-term care Medicaid after the penalty period has passed.

Work with a Medicaid Service Planner to Save Money

The financial eligibility standards for Medicaid, as previously indicated, are highly complicated. However, some methods and tactics can assist elders in becoming eligible. There are also several specialists who can assist. For example, Area Agencies on Aging case managers and geriatric care managers, and Medicaid planners are available to help.

How Medicaid planners can help

Medicaid planning can entail a wide range of services pertaining to Medicaid eligibility and application. A Medicaid planner may do one or more of the following tasks, depending on the needs of the client:

- Explain Medicaid eligibility and the application process

- Gather necessary documents for the client

- Check a client’s application file to ensure they have all the necessary information and documents before submission

- Provide asset structure advice

- Help clients meet financial eligibility requirements

3 key benefits of using a Medicaid planner

Many people benefit from working with a Medicaid planner. Engaging with one can be especially advantageous for people who would not otherwise be eligible for Medicaid or know how to apply. However, there are certain drawbacks. Here are three essential ways a trained Medicaid planner might help you.

1. Simplify the Medicaid process

A Medicaid planner can help you with the heavy lifting of determining what documentation you’ll need for your application, obtaining the documents you’ll need, and double-checking your application before submitting it. In addition, Medicaid planners are program experts who can help their clients understand any eligibility rules or coverage terms that they are unsure about.

2. Provide money-saving tips

These planners assist seniors in obtaining Medicaid, which can save them a lot of money on elder care costs such as nursing facility care. However, they can also educate clients to understand what not to do so that they don’t make significant errors that could result in losing Medicaid or incurring penalties.

A Medicaid planner can assist you in determining which eligible costs you may be able to pay for in order to reduce your income to the Medicaid limit while also ensuring that you do not spend too much on non-qualified expenses.

3. Prevent Medicaid penalties

As previously stated, Medicaid planners can assist their customers in becoming Medicaid eligible while avoiding as many penalties as feasible. For example, if someone rearranged their assets to meet asset standards, Medicaid will nearly always impose a penalty. Nonetheless, a Medicaid planner can assist you in understanding how to spend your money so that “spending down” penalties are minimal.

Costs Associated with Medicaid

In general, Medicaid enrollees don’t need to make any monthly payments. And co-pays are either non-existent or modest. However, if applicants choose to employ specific help, they may incur certain charges during the Medicaid application process.

What is Medicaid cost-sharing?

The states have a wide range of options when it comes to Medicaid coverage. Premiums and cost-sharing requirements can be imposed for those eligible, with copayments or deductibles set according to the guidelines in each state’s laws based on certain criteria like income level; however, there are always exceptions made relating specifically to vulnerable groups like minors and pregnant women from if they meet specific criteria – like low income.

Medicaid Coverage of Residential Senior Care

Long-term Medicaid care is available in nursing facilities as well as in the “home or community,” which includes services like home care, adult daycare, adult foster care, and assisted living. HCBS means “Home and Community-Based Services.” Home and Community-Based Services can be delivered through Medicaid Waivers or the standard state Medicaid program.

Medicaid and nursing home care

Medicaid covers long-term nursing home care for seniors who meet the program’s criteria. It is an entitlement program. But to be eligible for Medicaid coverage, seniors must be financially and medically eligible. Medicaid will then pay practically all associated costs, including a senior’s room and care services.

Medicaid and Assisted living

Medicaid waiver usually covers some approved assisted living services. As a result, seniors can expect assistance with medical treatment and personal care costs, which will lower their overall bills. On the other hand, the waiver program does not pay for the cost of room and board in an assisted living facility.

In most states, Medicaid can be used to pay for the following:

- Help with ADLs like toileting, mobility, and dressing

- Home health services, which may be provided in an assisted living community

- Physical, occupational, or speech therapy

- Medication management

Medicaid and in-home care

Eligible seniors can use their Medicaid coverage to hire a caregiver from a Medicaid-approved organization. First, a doctor must determine that the senior requires medical attention to the point where they would otherwise have to enter a nursing home. Medicaid Home and Community-Based Services (HBCS) exemptions or waivers are available in most states and give financial support to low-income seniors who require these services:

- In-home medical care, including physical therapy

- Assistance with ADLs

- Help with cooking, cleaning, and laundry

- Transportation

- Assistance with medical devices

Medicaid and dementia care

Though not all communities accept Medicaid, it does pay for 24-hour dementia care in many memory care facilities and memory-related care in skilled nursing communities. This typically includes all lodging and board expenses as well. Medicaid laws require seniors to devote the majority of their available money to their care, with only a little monthly “personal allowance” remaining.

Medicaid and independent living

Medicaid provides medical care to low-income and medically needy people. But independent living is not a part of Medicaid benefits as it does not include medical services. But Medicaid will cover the home health cost and some home care services in an independent living setting if the seniors meet the eligibility requirements.

Medicaid vs. Medicare: Key Differences

Medicare is a federally funded program that the government administers. It primarily targets and covers people who are 65 or older or have a disability, regardless of their income.

Medicaid is a federal and state-run assistance program that offers health coverage to people with extremely low incomes. Medicaid does not give money to the enrollees; instead, it pays healthcare providers directly. Therefore, eligibility is mainly influenced by one’s financial situation. Compared to Medicare, Medicaid programs provide a broader range of healthcare services.

How to become Eligible for Dual Health Plans with Medicare and Medicaid

It is possible to be eligible for both Medicare and Medicaid simultaneously. You are termed “dual eligible” if you

- Qualify for Medicaid in your state

- Qualify for Medicare Parts A and B (Original Medicare)

- Live in a dual-eligible plan’s coverage area

In that case, you will be enrolled in a dual health plan. This plan is a sort of Medicare Part C that is unique. Dual health plans are a type of health insurance coverage that is available to individuals who are enrolled in both Medicaid and Medicare. This type of coverage is designed to provide enrollees with the best possible care by combining the resources of both programs.

Private insurance firms provide dual health plans that allow you to choose the best coverage for you and your health care needs. For persons who are enrolled in both programs, Medicaid may pay some costs of Medicare premiums, copayments, and deductibles.

Medicaid and Covid-19

Medicaid changed in response to the COVID-19 virus to better protect seniors from getting the virus. This included changes to what services are covered and how eligibility is determined. Here are the changes that were made in response to the virus:

Federally Enhanced Funding

States that satisfy specific conditions can get cash to assist people in getting and keeping health insurance.

Telehealth Services

The rise of telehealth services has been a huge breakthrough for patients with remote conditions that often require specialist care. These doctors can now provide their expertise from afar, cutting down on travel times and expenses while still providing you all the same quality service. The visits can be conducted over the phone or via videoconference. Some jurisdictions have increased their offerings to include telehealth services as a result of the pandemic. This includes visits to the doctor as well as a behavioral health treatment.

Prescription Drugs

Several jurisdictions used a pharmacy cost-containment strategy to keep costs down during the pandemic. Prescription drug cost control is still being implemented in certain jurisdictions.

Conclusion

Medicaid is an important program that helps millions of Americans receive the health care they need. We hope our guide answered your questions about how Medicaid works, who is eligible, and the benefits of enrollment.

Frequently Asked Questions(FAQs) related to Medicaid

Is Medicaid a free benefit for seniors?

Medicaid, in most cases, is free. Although states are allowed to impose a cost-sharing requirement, Medicaid typically has no premiums, deductibles, or co-pays because it is designed for low-income families and people with extremely high medical expenses.

What is the main difference between Medicare and Medicaid benefits?

Medicare and Medicaid are both government-funded insurance systems, but they differ significantly. Medicaid is an income-based program provided to selected people who meet specific financial criteria. As it is a state program, the eligibility requirements vary across states. However, regardless of income, all persons aged 65 and up are eligible for Medicare. This program is also open to younger people with end-stage renal disease, Lou Gehrig’s disease, or who have received Social Security Disability benefits for at least 24 months.

Does Medicaid pay the family caregivers?

Informal family caregivers may be able to receive Medicaid reimbursement for their services. In addition, seniors may be eligible for consumer-directed or self-directed waivers, providing a needs-based stipend to employ their own carers.

What is CHIP in Medicaid?

Children whose parents do not qualify for Medicaid can be eligible for the Children’s Health Insurance Program (CHIP). States are in charge of administering CHIP, which the federal government mandates. Therefore, states and the federal government contribute to the program’s funding.

Who qualifies for Medicaid?

To be eligible for full Medicaid coverage, you must first be a United States citizen or lawful permanent resident. One’s income determines Medicaid eligibility. Your eligibility is also determined by whether you have a disability, the size of your family, and your age. Though the requirements differ by jurisdiction, both your assets and income are taken into account. Some seniors may be eligible for both Medicare and Medicaid.

Does Medicaid pay for assisted living?

The Medicaid waiver program does pay some components of assisted living costs. For example, it will cover personal care and medical expenses in Assisted Living Facilities (ALFs).

Does Medicaid pay for independent living?

Because Medicaid covers only medical services, it does not pay independent living expenses.

Does Medicaid pay for Alzheimer’s care?

Yes, Medicaid covers a wide range of dementia-related expenses, including Alzheimer’s and memory-related expenses. On the other hand, Medicaid may not cover all dementia care expenditures and the costs of specific programs or support communities.

Does Medicaid pay for Skilled Nursing Facilities (SNFs)?

Yes, Medicaid will cover nursing home care for seniors who need it and meet the program’s financial criteria. In addition, Medicaid will cover the entire cost of nursing home care, including room and board, for individuals who qualify.

Does Medicaid pay for in-home care?

Yes, Medicaid will pay for in-home care