Article Contents

Introduction

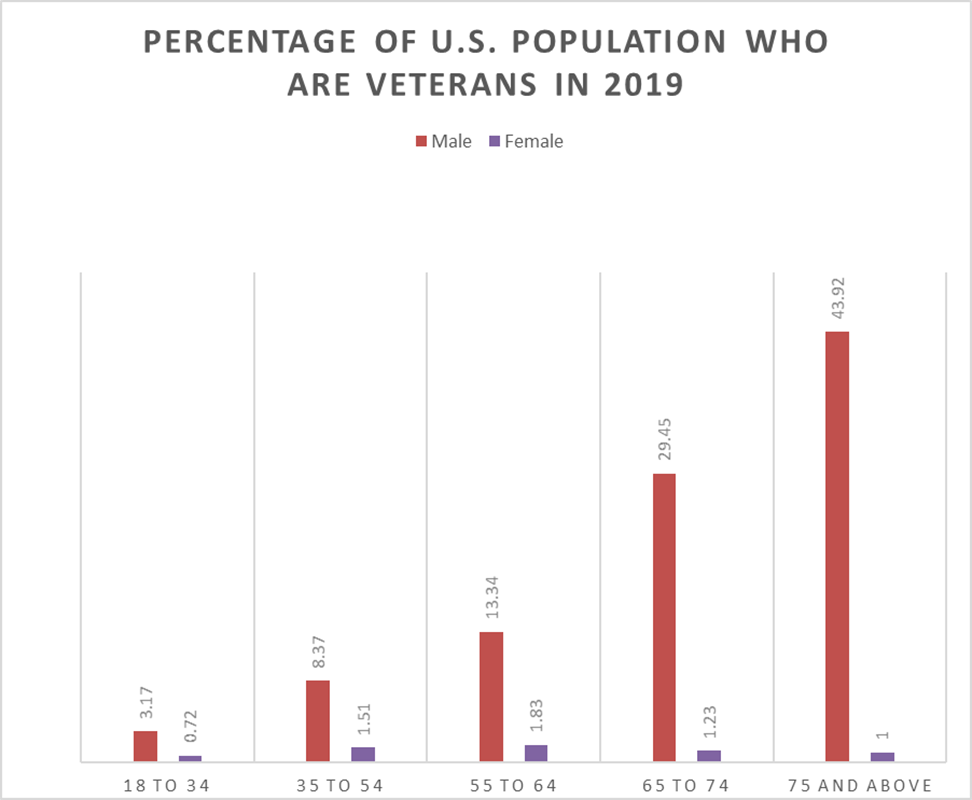

The US veteran population makes up to about 19 million brave men and women who have actively served, or are serving, in the army, navy, air force, coast guard, or marine corps. Each veteran has served for different periods, during the war and in peacetime. According to the Census Bureau, roughly 7% of adults in the United States were veterans in 2018, declining from 18% during 1980. This decline corresponds to a reduction in soldiers deployed. According to the Veteran Administration (VA) forecast, the number of living veterans will decrease over the next 25 years. It is estimated that there will be roughly 12.5 million veterans by 2046, a 35 percent decline from present figures. By that time, Gulf War veterans are expected to make up the majority of those who served, while most Vietnam War veterans will have passed away.

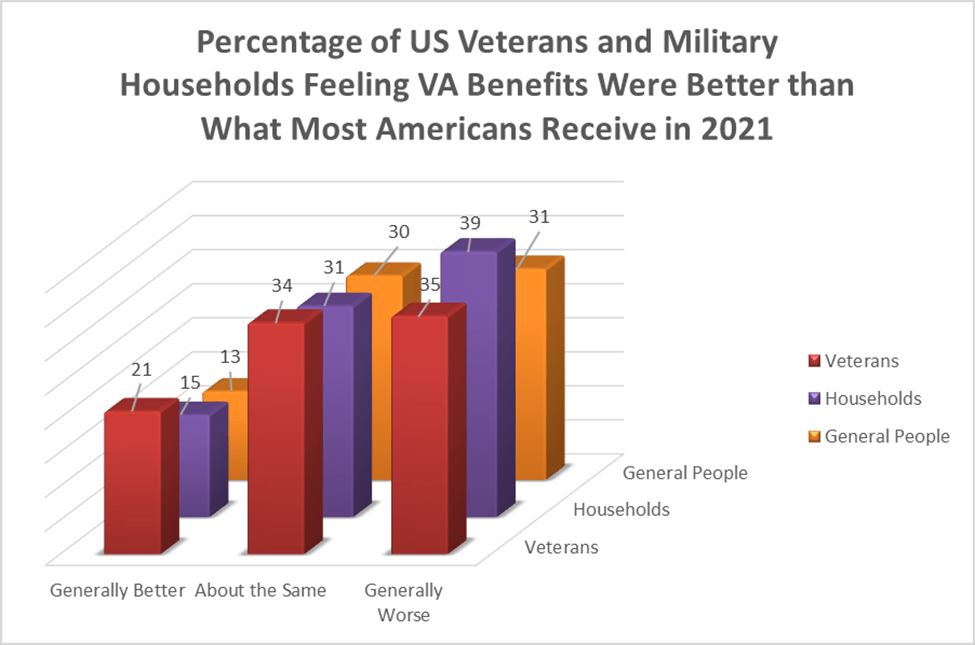

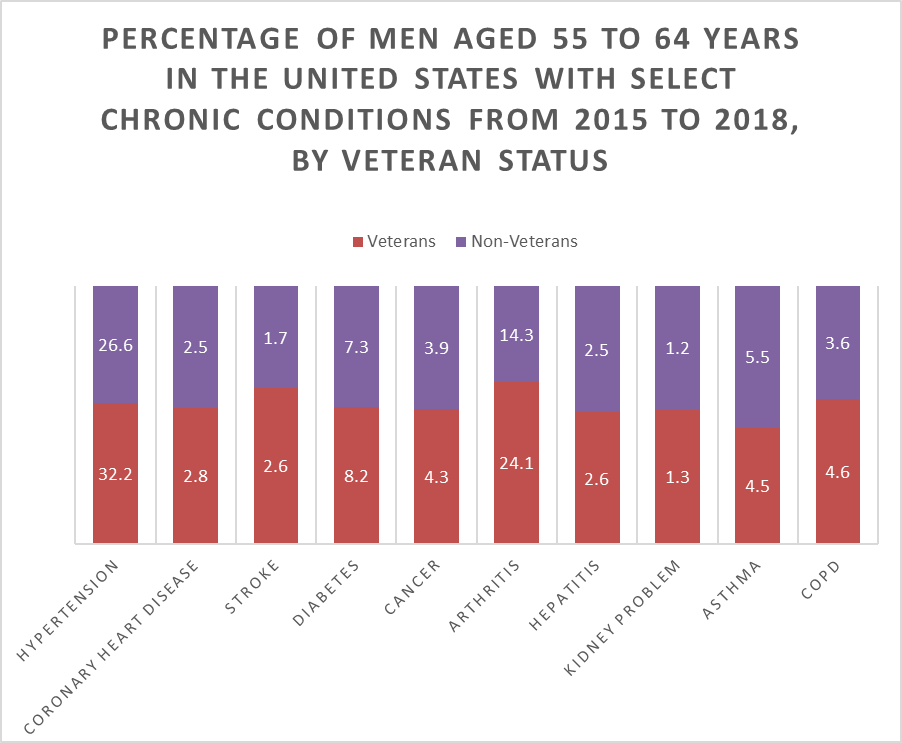

The retired, disabled veterans, and their dependents require the necessary financial benefits to make sure they remain healthy and in good living conditions. The VA provides medical help, care, benefits, and other essential services related to health and senior living to veterans of the US armed forces and their families. It may also provide burial and memorial benefits to eligible veterans and family members. These services cover a majority of health-related problems, particularly those faced by veterans when they are older.

Whether you have a minor disability or require senior care as you grow older, plenty of assisted living and options are available for you or your loved one.

What Kinds of Long-term Care Services Does VA Offer for Sick or Disabled Veterans?

To plan for long-term services and support, VA Medical Centers and Healthcare Systems across the country use a collaborative process called Shared Decision-Making (SDM). The SDM allows Veterans and their providers to make health-care decisions together while considering the best scientific evidence available and the Veteran’s values and preferences.

You may be entitled to VA assisted living, nursing care, or in-home health care service support as a Veteran. The following choices are available to serve Veterans and their survivors’ long-term service and support needs.

In-home and Community-based Options for Veterans

The list of programs offered by the VA for in-home care support to the veterans are listed below:

Adult day health care

Adult Day Health Care is a daytime program that provides social activities, recreation, group therapy, and companionship to Veterans.

Veterans who require assistance with Activities of Daily Living (ADLs) like assistance with bathing, dressing, or preparing food are eligible for the program. This program is also for Veterans who live alone or whose caregivers are under a lot of stress.

Primary home care

Veterans can receive health care in the comfort of their own homes through Home Based Primary Care. The health care team that offers the services is overseen by a VA physician. Home-based primary care is for Veterans with complex health care needs who are unable to receive adequate care in a clinic setting.

Palliative care

Palliative Care is a type of comfort care that focuses on alleviating pain and regulating symptoms so that you can conduct your daily and essential activities comfortably. This type of care strives to promote your mental, physical, and spiritual well-being.

Home respite care

Home respite care pays for caregivers to get to your home for daily care. It also pays for those Veterans who want to visit an adult day health care program regularly. In addition, respite care enables break time and personal time for family caregivers while professional caregivers take care of the veterans.

Telehealth

Telehealth is a program that includes healthcare professionals to monitor physical or mental health virtually. Any member of a veteran’s care team can refer a veteran to a care coordinator for registration in Remote Monitoring services.

Resident care options for veterans

Resident care programs for veterans mean shifting to a senior care community and getting assistance for it. The VA supports the following long-term care options for veterans.

Community Residential Care (CRC)

Veterans without the need for nursing home care but cannot live alone due to physical or mental issues are eligible for the Community Residential Care (CRC) program. A variety of venues, including Assisted Living Facilities (ALFs), provide this type of care.

Medical foster home

Medical Foster Homes provide 24/7 care and monitoring services through primary caregivers in private residences. The caregivers can assist the Veteran with ADLs such as bathing and dressing. Veterans receive Home Based Primary Care while residing in a Medical Foster Home.

Assisted living benefits for veterans

Assisted living communities are places where veterans can reside in an apartment or a house room. There are many benefits available for veterans. The VA offers a series of advantages for all its veterans. Some of these may include an increase in pensions to pay for assisted living care. Veterans living in assisted living need some form of financial stability.

Nursing home options for veterans

The following are some of the program that assist veterans in receiving care in nursing homes:

Community nursing homes

Veterans can live in a Community Nursing Home full-time and get skilled nursing care. Many cities provide the Community Nursing Home program, which allows Veterans to receive care close to their homes and families.

State veteran homes

Nursing homes, adult daycare, and domiciliary care are all available at State Veterans Homes. State governments own, maintain, and administer these facilities.

Community Living Centers (CLC) A CLC is a specialized nursing home under the VA. You can find more than 100 CLCs all over the country. These homes are designed to provide home-like care and environment as much as possible.

Are There Assisted Living Facilities Available for Senior Veterans?

If you’re wondering if there are only veterans’ nursing homes or assisted living facilities, then you’d be correct. But, of course, there are veteran homes- hence the name- in certain cases- dedicated to taking care of only those who have served our nation.

Some disabilities- whether they are physical or mental- require special care. To ensure that the veteran receives the proper care, it is not wise to keep them under civilian doctors and nurses who don’t understand the psychological aspect of many disabilities.

These facilities, therefore, include doctors, nurses, and caregivers who understand the sacrifices our heroes have had to make. They are trained to ensure that their needs are taken care of properly.

What can you expect from these assisted living communities for seniors?

Veterans might reside in an apartment or rent a room in an assisted living facility. Shared living areas, such as a dining area and entertainment spaces with social and entertainment events, are popular in these communities.

Veterans can benefit from specialized caregiver assistance at an assisted living facility. The caregivers can help with the following things:

- Hygiene like bathing, toileting and dressing

- Housekeeping services like laundry and cleaning

- Preparation of meals

- Reminders to take medications

- Medical attention

Veteran Benefits that Can be Used to Cover the Cost of Long-term Care?

The VA Aid and Attendance (A&A) benefit and the Housebound or Household benefit are two veteran benefits available to help pay for long-term care. Long-term care benefits for veterans are a monthly stipend added to the VA Pension or Survivors Pension. Unfortunately, receiving Housebound and Aid and Attendance benefits simultaneously is not possible.

VA Aid & Attendance (A&A)

Aid and Attendance is a need-based payment option for veterans. You get this amount over the veteran pensions you receive. The idea of the payment is to cover the long-term costs of senior living expenses.

A simple example can be paid caregivers for daily living assistance. You may need someone to move around, dress and undress, eat, groom, and do other ADLs. The caregiver you hire must be paid accordingly for these tasks. How do you pay for them? You can apply for the A&A benefits as a veteran.

A&A eligibility

To qualify further for aid, the veteran must meet at least one of these requirements:

- Require aid from another person for personal functions such as bathing, feeding, dressing, etc.

- Require a nurse to look after them.

- Unable to move out of bed except for prescribed physical therapy.

- Eyesight is limited to corrected 5/200 visual acuity or less in both eyes.

- Have limited or have no income,

- Need assistance for a nursing home.

Household benefits

Veterans and surviving spouses who spend the majority of their time at home due to a persistent disability are eligible for VA Housebound benefits. Housebound beneficiaries are confined to their homes or require the assistance of others while leaving for medical appointments or treatments.

Household benefits eligibility

If you qualify for a VA Pension or Survivors Pension, you may also be eligible for Housebound benefits. Here are the criteria to be eligible for household benefits:

- Having a permanent disability

- Confined at home due to the disability

- Leaving the house only for medical appointments and treatments

Who Qualifies for VA Benefits

Veterans and family members seeking veterans benefits for senior care must meet different criteria depending on the sort of benefit they’re searching for.

Service requirements

Qualifying veterans and their surviving spouses are eligible for veterans benefits for senior care if they were on active service for at least 90 days. This 90-day period also includes at least one day during a wartime period. Your senior loved one must meet at least one of the following service requirements to be eligible for VA benefits:

- Joined the forces for active duty before 8th September 1980 and served a total of 90 days with a minimum of 1 day of wartime service

- After September 7, 1980, served as an enlisted person on active duty for at least 24 months, or the whole period for which the veteran was called or ordered to active duty (with limited exceptions), with at least 1 day during wartime

- Served on active duty as an officer after 16th October 1981 without having previous active duty services for at least 2 years

Financial requirements

To qualify for VA benefits, you must fulfill the minimum financial eligibility standards. This means your relative’s net worth must be less than $138,489, the congressionally imposed cap until November 30, 2022. This sum is subject to change every year. The household income and assets that make up your loved one’s net worth are as follows:

- Salary or hourly pay, commissions, bonuses, Social Security Benefits, tips, any retirement payments, and any income received by your loved one’s spouse and dependents are all included in your annual income.

- Personal property like land, home furniture, and investments are examples of assets. On the other hand, assets do not include your loved one’s principal property, car, or essential household things such as appliances that they would not take with them if they moved to a new home.

Clinical requirements

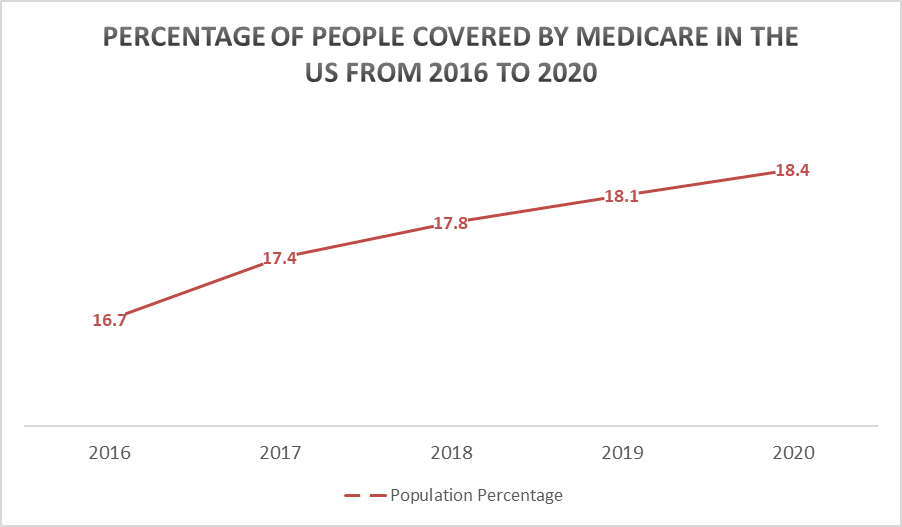

Veterans 65 and older are generally eligible for VA long-term care benefits. Still, individuals under 65 who have a permanent disability may also be qualified. Clinical requirements vary depending on the benefit. Those who require assistance with ADLs receive the highest amounts.

Lock-in period

Veterans who transfer assets for less than market value to someone else, such as a friend or family member, may face a penalty in the three years before applying for VA benefits. If the transferred assets had otherwise prohibited the veteran from receiving VA benefits, this could happen. Veterans who have been subjected to a three-year look-back penalty may be denied benefits for up to five years.

How Does the VA Decide the Total Amount?

If your loved one is eligible for VA benefits, their payment rate will be determined by their household earnings and the Maximum Annual Pension Rate (MAPR) set by Congress. The MAPR for your loved one is determined by several variables, including:

- The total number of dependents

- Their marital status to another veteran

- Qualification for A&A and household benefits

MAPRs go through annual adjustments as cost-of-living increases each year. Find your 2022 MAPR amount from the list below.

Find the MAPR amount you can get

| Veteran Status | MAPR (in USD) | Monthly Amount (in USD) |

|---|---|---|

| No dependent and unqualified for household and A&A benefits | 14,753 | 1,229 |

| No dependent and qualified for only household benefits | 18,029 | 1,502 |

| No dependent and qualified for only A&A benefits | 24,610 | 2050 |

| 1 dependent and unqualified for household and A&A benefits | 19,320 | 1,610 |

| 1 dependent and qualified for only household benefits | 22,596 | 1,883 |

| 1 dependent and qualified for only A&A benefits | 29,175 | 2,431 |

| Married to another veteran and both are unqualified for household and A&A benefits | 19,320 | 1,610 |

| Married to another veteran and one of them is qualified for household benefits | 22,596 | 1,883 |

| Both qualify for household benefits | 25,870 | 2,155 |

| Married to another veteran and one of them is qualified for A&A benefits | 29,175 | 2,431 |

| Both qualify for A&A benefits | 39,036 | 3,253 |

| One veteran is qualified for household benefits and the other veteran is qualified for A&A benefits | 32,443 | 2,703 |

| Spouse/Dependent Situation | MAPR (in USD) | Monthly Amount (in USD) |

|---|---|---|

| Widowed with no dependent | 9,896 | 824 |

| Widowed with 1 dependent | 12,951 | 1,079 |

| Widowed spouse, no dependent, and qualified for A&A benefits | 15,816 | 1,318 |

| Widowed spouse, 1 dependent, and qualified for A&A benefits | 18,867 | 1,572 |

| Widowed spouse, no dependent, and qualified for household benefits | 12,094 | 1,007 |

| Widowed spouse, 1 dependent, and qualified for household benefits | 15,144 | 1,262 |

Benefits that the VA Amount Will Cover

Veterans and their widowed spouses may be entitled to financial aid to help cover the costs of assisted living, memory care, home care, and nursing facility care. Both A&A and Housebound benefits can be used to help pay for personal care provided by any non-licensed in-home caregiver, including a family member or friend.

Veteran benefits for assisted living

The cost of assisted living varies from one location to the next, including facilities, unit size, and amount of care required. According to Genworth’s Cost of Care Survey, the median monthly cost of assisted living in the United States is around $4,300.

If a veteran or his or her surviving spouse qualifies for A&A benefits, they may be eligible for a monthly supplemental payment to help defray the cost of care in an assisted living facility, as long as the care includes assistance with ADLs and IADLs.

Veteran benefits for independent living

Independent living facilities typically do not provide assistance with ADLs which is one of the conditions for A&A eligibility. However, some residents of independent living facilities may require home care services in the future to assist them with personal care. Therefore, aid and Attendance’s extra income may be available to eligible seniors who live in an independent living community but require assistance with ADLs.

Veteran benefits for nursing homes

The cost of a nursing home varies depending on the location and degree of care provided. According to Genworth’s Cost of Care Survey, the median monthly cost of nursing home care in the United States is roughly $7,756 for a semi-private room and $9,000 for a private room.

As long as they are an eligible veteran or the spouse of a deceased veteran, residents in nursing homes often require assistance with ADLs. This makes them eligible for A&A financial assistance.

Veteran benefits for memory care

Seniors with Alzheimer’s Disease (AD) or dementia receive memory care, also known as Alzheimer’s care. Memory care is typically 20-30% more expensive than assisted living in any given area. It could cost roughly $5,375 per month, based on the average monthly cost of assisted living in the United States of $4,300. A&A benefits may be an essential option to help people pay for memory care services.

Veteran benefits for home care

The cost of in-home care varies substantially depending on the type of care required and how frequently it is offered. However, in the United States, the average cost of home care is $23 per hour. Seniors who are Aid and Attendance eligible and get home care assistance with activities of daily living such as bathing or dressing may be eligible for extra income to help pay for these services.

Veteran Benefits for Surviving Spouses and Dependents

You may be eligible for certain benefits as the spouse or dependent child of a Veteran. This includes health care, life insurance, or money to assist pay for education or training.

Health care benefits

You may be eligible for health care benefits if you are the surviving spouse, family caregiver, or dependent child of a Veteran. You may also qualify for health care benefits if your veteran loved one has a service-related disability.

Employment benefits

You can find out if you’re eligible and how to apply for educational and career counseling benefits as a dependent family member of a veteran with a service-connected disability through Personalized Career Planning and Guidance.

Education and training benefits

You may qualify for Chapter 35 VA benefits or employment training through a GI Bill program if you’re a dependent or surviving spouse or child of a Veteran.

Home loan benefits

You’ll require a Certificate of Eligibility (COE) to prove to your lender that you qualify for a home loan as the surviving or widowed spouse of a Veteran. Check to see whether a COE is available. To secure a loan, keep in mind that you’ll need to meet your lender’s credit and income requirements.

VA life insurance benefits for surviving spouse

Veterans, service members, their families, and dependent children can all benefit from VA life insurance. To collect the insurance benefits you’ve earned, look into your alternatives, manage your coverage, and file claims.

Medical Facilities

Some allowances are in the form of medical expenses. This includes a wide range of medical facilities such as hospitals, medical, and medical bills. The medical facilities allowance is decided by the veteran administration again.

If not a monthly stipend, it aims to cover all medical costs. Those who are eligible for this facility are as follows:

- Veterans over the age of 65

- Veterans who are suffering from any form of physical or mental illness. This includes some form of a disease.

- Veterans who do not have enough pension or financial coverage

- Senior veterans who need additional medical assistance

- Veterans who require a nurse to function daily. It includes doing daily tasks etc.

What Is the Veterans Health Association (VHA)?

The Veterans Health Administration, as you know, is one of the two parts of the Veterans Administration. It’s basically a network of health care centers across the United States with over 1,200 facilities and over 150 VA medical centers.

All of these centers dedicate themselves to ensuring that veterans are able to get immediate and emergency medical care.

What are some of the standard VHA medical benefits?

You’ll be happy to know the Veterans Administration has made it a point to ensure that the VHA standard medical benefits are as comprehensive as possible. In fact, these even include necessary inpatient and outpatient hospital services.

In general, the VHA benefits include traditional hospital-based services such as surgery and critical care as well as more specialized surgical services including:

- Audiology and speech pathology

- Dermatology

- Dental

- Geriatrics

- Neurology

- Oncology

- Organ transplantation

- Plastic surgery

- Podiatry

- Prosthetics

- Urology

- Vision care

Application Process and Resources You should Know about

The first step in applying for veteran benefits is to find out if your loved one is eligible for VA long-term care benefits. After that, you’ll need to gather some documents and information, such as:

- The VA file number or Social Security Number (SSN)

- The veteran’s military history

- All the financial information of the veteran and his or her dependents

- Direct deposit and bank account information

- Your original discharge papers (DD-214)

Veterans under the age of 65 will also need the following information:

- Your medical information

- Your work history

- Marriage certificate of parents when dependent children applying

How to apply for VA benefits

On the VA website, you can assist your loved one in applying for veterans benefits. If you are assisting in creating an account, they will be able to preserve their work as you help them in gathering the necessary information and papers for their application. Photocopies of any original documents should be kept.

Application for veterans benefits is also possible by mail. Send their Application for Pension form to the Pension Management Center of the VA, or in person at a VA site near you.

How long does the application and approval process take?

The veteran benefits application process can go a little slow. There are several steps that the application will go through. First, you will need to gather all the documents and then make the application with a VA form. So, it may take several months to get a final discussion from beginning to end.

But the best part about the VA benefits is that it is a retroactive payment. This means that you will get a lump sum in the first benefit payment to remedy the losses of the pending months.

How Can Veteran Benefit Planners be Useful?

There is a multitude of benefits available to veterans, and it’s not always clear how to qualify for or make the most of them. Veterans benefits planners can advise veterans and surviving spouses on possible benefits and help with applications, representation, and appeals.

How veterans benefits planners help

Veterans should consider collaborating with a veterans benefits planner to streamline the benefits application process and potentially earn more benefits than they would if they worked alone. Planners can help veterans receive benefits faster by making disability and pension claims less complicated, removing roadblocks, and speeding up the claims process.

A competent veterans benefits advisor can assist veterans and their families in meeting their eligibility requirements to the fullest extent possible. For example, planners may be aware of income limit exclusions such as homes, vehicles, and life insurance policies. A planner can also assist in getting military or medical records to substantiate claims.

Veterans benefits planners provide different services depending on the type of advisor and their relationship with the VA. Veterans Service Officers, for example, are employed by the VA or veterans organizations such as the American Legion and can help with application preparation, filing, and claim work. Though some may be accredited, most veterans pension planners are not affiliated with the VA. These planners assist families in budgeting so that they can receive the maximum benefit amount. However, accreditation is necessary if you want an advisor to officially represent you when you file a claim.

The total costs of hiring veteran benefits planners

Except for attorneys who try to overturn refused claims, most veterans benefits planners provide their services for free. No one or organization can legally charge for assistance in preparing VA benefits applications or filing claims to the VA.

Planners employed by the VA for non-profit organizations have salaries and are not compensated directly by veterans. Attorneys and other advisors, on the other hand, can charge for claims appeals and other related services, such as real estate planning.

Attorneys and planners frequently provide free assistance in the preparation of applications. If VA refuses a claim, an attorney or planner will charge a fee to review it. This is usually calculated as a percentage of the gains, by the hour or by the project.

VA Agents at Your Service

Veterans’ assistants are also people who have served in the military before. They are retirees who now serve in the army as assistants. Their purpose is to assist the veterans who are there.

They provide medical and personal advice to veterans who are currently serving as one. The veteran assistant agents are extremely vigilant at what they do. These agents provide proper consultation and advice regarding veterans.

The VA agents even help in assessing veteran agents in deciding what loan programs to pick. They even provide aid and assistance in all capacities. Veterans’ assistant agents are the perfect guide for veterans.

FAQs

How can I obtain emergency assistance with paying my delinquent utility bills, rent, mortgage, etc.?

You can visit the State Department of Veterans Affairs website to check for stats-specific assisted living benefits for veterans through the National Resource Directory. If you’re having trouble with finding information, you can even ask your local veteran’s service organizations for help.

How do I submit a claim for disabilities from my active-duty service or re-evaluate my disability compensation claim?

You can make a claim for services by submitting your application via eBenefits or you can submit it to a VA regional office in your city.

What health benefits am I entitled to?

Depending on your health and disabilities, you may qualify for a number of assisted living benefits for veterans. Since each case is different, it depends significantly on your specific case and the benefits you will receive.

Does the VA provide life insurance?

While the VA does not provide a full-blown life insurance program, there is the Veterans’’ Group Life Insurance (VGLI) option available for those looking for health assistance. If you’re applying between June 11, 2020, and December 11, 2021, you can:

- apply without needing to have to prove your health for up to 330 days

- apply with a health review for up to 1 year and 210 days.

Do I need an in-person appointment for VA benefits?

The regional offices are temporarily not open due to COVID-19. But, the offices are open for a limited time only, with screening done for visitors for COVID-19 symptoms. Everyone coming in for an appointment must cover their mouth and nose.

Can my spouse get half of my VA disability?

According to the VA’s website, a veteran’s surviving spouse is eligible for DIC compensation if they meet specific criteria.

Do Veterans get free healthcare?

If you qualify for a disability payment, the Veterans Independence Program, the War Veterans Allowance, or financial help from VAC for long-term care, you will be eligible for healthcare coverage and a VAC healthcare card.

Are Veterans homes free?

No, veteran homes are not free as there are daily, monthly, or yearly charges appliable for each veteran resident.

Are There Assisted Living Facilities Available for Senior Veterans?

There are many assisted living facilities for senior veterans who cannot live independently in their later years. If you, or any of your loved ones, have served in the US armed forces, there are various options available for you.