Article Contents

Assisted living facilities are a handy option for older adults who need assistance with activities of daily living. It is relatively cheaper than nursing homes and has various services and amenities tailored toward individual needs. Still, many seniors would require financial assistance in paying for assisted living costs.

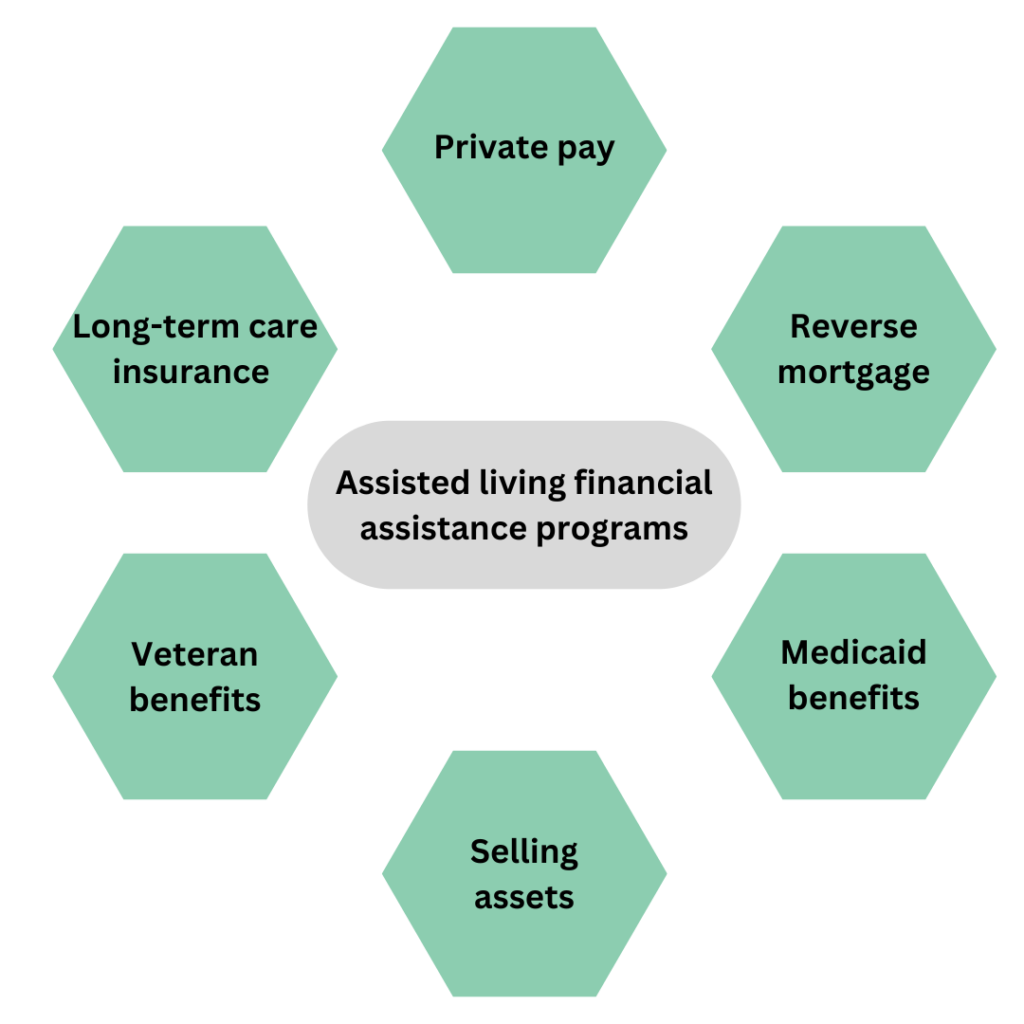

So, if you are wondering how to pay for assisted living or get some financial assistance to cut down the costs, you’re at the right place! In this blog post, we will explore the assisted living financial assistance programs available for older adults, as well as some other financing options for your future senior housing. Let’s get started!

Understanding the cost of assisted living care

While considering assisted living, it is important to understand the total cost of care associated with it. Many seniors and their families only consider the monthly fee, but fail to take into account additional expenses such as medical supplies, transportation, and personal care items. Additionally, the cost of care may increase over time as care needs change or health conditions worsen.

The cost of assisted living varies depending on the facility location, amenities, and level of care required. Any additional services such as medication management, specialized care for dementia or other health conditions, and transportation may incur additional fees. So, it is best to compare the cost of different assisted living facilities in your area before moving in.

What is financial assistance for assisted living?

Financial assistance for assisted living can come in many forms, including federal and state programs, private insurance, and personal savings. These options are available to help seniors cover the cost of assisted living and other long-term care expenses. The eligibility requirements for financial assistance vary depending on the program and state. It is recommended to ask yourself these questions while considering an assisted living facility:

- Do you have enough savings to cover the cost of assisted living for an extended period of time?

- Are you eligible for any government programs?

- Which option is right for you?

How to pay for assisted living?

It’s no secret that assisted living can be expensive. But don’t let that discourage you from exploring your options. There are numerous financial assistance programs available to help seniors cover the cost of long-term care. Here’s how to pay for assisted living using personal funding and government support:

1. Private pay

Private pay or paying out of pocket is the safest way to pay for assisted living. Private pay is an option for those who have savings, investments, or retirement funds they can use to pay for assisted living. While paying for assisted living through private pay can be a daunting task, it is not impossible. With proper planning and research, you can find a way to pay for assisted living that fits your needs and budget.

2. Reverse mortgage

Reverse mortgages are a type of loan against a person’s home equity. Elderly homeowners with significant home wealth can borrow and receive money against the value of their property. The amount is offered in the form of a fixed monthly amount, a lump sum payment, or a credit line. The money can be used towards paying for assisted living.

3. Medicaid

Medicaid is a joint federal and state program that provides healthcare coverage for low-income individuals and families. Many states offer Medicaid waivers that can help cover the cost of assisted living for eligible seniors. However, eligibility requirements vary by state and may be based on income, assets, and care needs.

How to pay for assisted living

4. Veteran benefits

Seniors who served in the military may be eligible for veterans benefits that can help cover the cost of assisted living. The US Department of Veterans Affairs offers several programs that provide financial assistance for veterans and their spouses, including the Aid and Attendance benefit and the Veterans Directed Home and Community Based Services program.

5. Long-term care insurance

Long-term care insurance is a type of insurance policy that covers the cost of long-term care services such as assisted living, skilled nursing, and home health care. Seniors who have long-term care insurance policies may be able to use the benefits to pay for assisted living. However, it’s important to review the policy carefully to understand the coverage limits, waiting periods, and exclusions.

6. Selling assets

Selling assets can be a way to generate funds to pay for assisted living costs. While it may be a difficult decision, it may be necessary in some cases. There are different types of assets that can be sold such as real estate, vehicles (e.g., cars, boats, RVs, etc.), and personal items (e.g., jewelry, art, antiques, collectibles, etc.)

Final thoughts

Assisted living can provide seniors with the support and assistance they need to maintain their independence and quality of life. However, the expenses can be a barrier for many seniors and their families. Understanding the cost of care and exploring financing options can help seniors and their families make informed decisions about their care.

We hope this article helps you find answers to questions like how to pay for assisted living or how to get financial assistance from different programs. If you need more information or free consultation, please give us a call today!

Related articles:

- Paying for home care: what are the options?

- Finding The Right Affordable Assisted Living for Low-Income Seniors

- A Beginner’s Guide to Medicaid

- Medicare Benefits for Seniors: Complete Guide

- Military Veteran Insurance & Healthcare Coverage Options

FAQs

- Does Medicare pay for assisted living?

Since assisted living mostly provides non-medical care, Medicare typically does not cover the expenses. However, there may be some short-term coverage for certain medical services or supplies provided by a healthcare professional within an assisted living facility. This usually falls under Medicare Part B (medical insurance) and requires meeting certain eligibility criteria.

- How to get into assisted living with no money?

If you or your loved one needs to get into assisted living but have no money, there are a few options to explore:

- Look for low-income assisted living facilities

- Apply for Medicaid

- Explore non-profit organizations or charities

- Use reverse mortgage

- Sell assets