Article Contents

As we age, one thing becomes increasingly apparent, we all want to maintain our independence for as long as possible. Independent living facilities provide older adults a hassle-free retirement with all the necessary amenities. However, it can come at a steep cost, leaving many elderly individuals struggling to pay for the care and support needed to live comfortably and safely on their own.

The good news is that various options are available to help cover the costs of independent living, no matter your financial situation. So, if you are considering senior living or wondering how to pay for independent living facilities, you are at the right place!

This post will explore some of the most common options for paying for independent living. From government assistance programs to private insurance plans – there are many ways to finance your independent living journey and make the most of your golden years.

What factors impact the cost of senior independent living?

Several factors impact the cost of independent living facilities. While basic communities cost less, high-end retirement homes cost a lot more due to extra amenities, quality of services, better living spaces, etc. Let’s look at some of the significant factors affecting the price.

1. Location

The cost of senior independent living can vary greatly depending on the location. Urban areas and coastal cities tend to have higher costs of living, which can affect the cost of senior independent living.

2. Level of care

Some senior independent living communities offer more extensive care services than others. The level of care provided can impact the cost of independent living.

3. Amenities

55+ communities offer a range of amenities, from swimming pools to fitness centers to dining options. The more amenities a community offers, the higher the cost.

4. Size of living space

The size of the living space can also impact the cost of independent living facilities. Larger apartments or private rooms will typically come with a higher price tag.

5. Additional services

Some independent living communities include utilities, transportation, and other services in their monthly fees. The more services included, the higher the cost.

What is independent living financial assistance?

Independent living financial assistance refers to the support provided for senior citizens, veterans, or individuals with disabilities. These types of assistance can be provided through various sources, including government programs, non-profit organizations, or private insurance.

The goal of independent living financial assistance is to help individuals with disabilities or who are aging to maintain their independence and live full and active lives in their communities. But in most cases, independent living financial assistance programs have specific eligibility criteria and waiting periods.

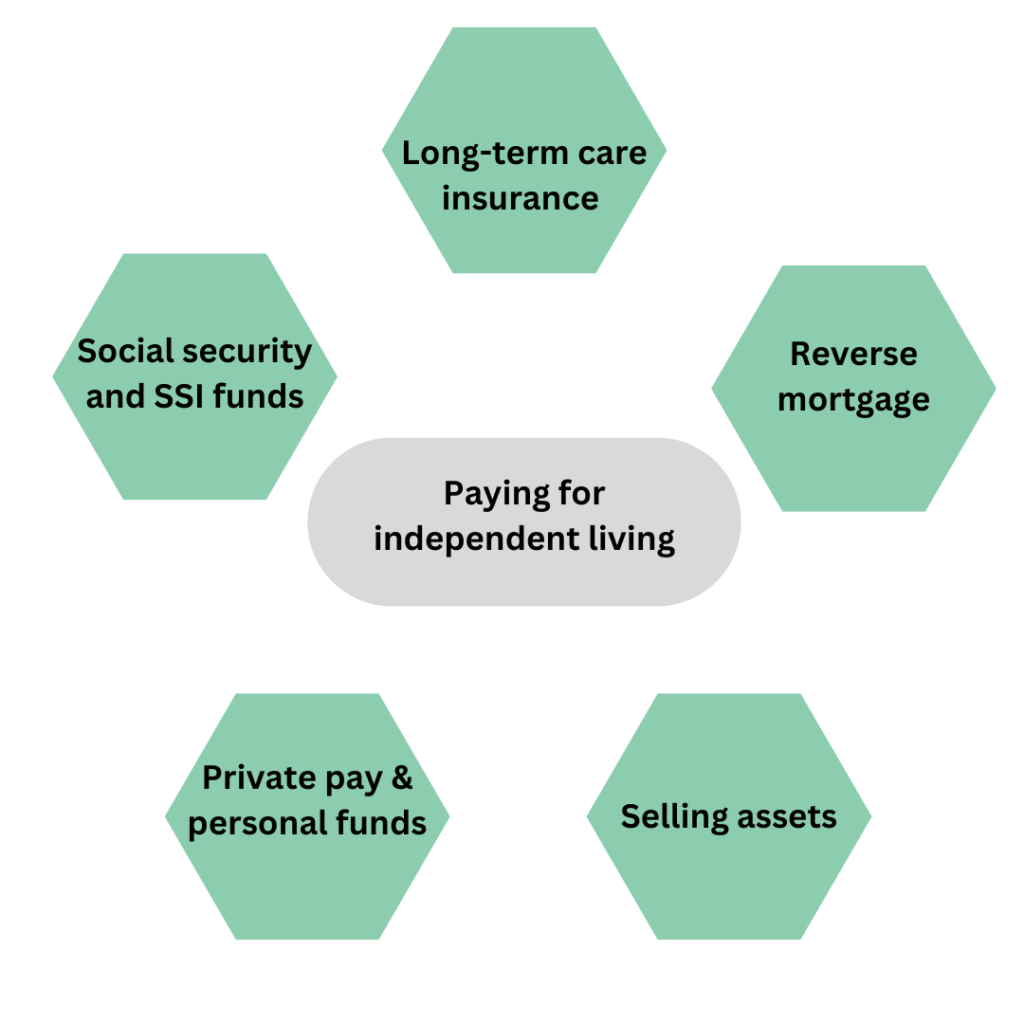

How to pay for independent living?

Paying for independent living facilities can be challenging for older adults with fixed incomes. But there are several ways to finance their retirement living costs. Here’s how to pay for independent living:

1. Long-term care insurance

Long-term insurance is designed to help pay senior living costs, including independent living. But while purchasing long-term care insurance, it’s important to do some research. Policies vary widely regarding what they cover, how much they cost, and their limits. So be sure to compare plans from different providers to find one that fits your budget.

2. Reverse mortgage

A reverse mortgage is a form of loan that allows the proprietor to convert portions of the home equity into cash. It can be a helpful way to pay for independent living facilities, as the money can be used toward covering the costs of the facility. However, it’s important to note that there are risks associated with reverse mortgages, so it’s advisable to speak with an elder law attorney before making any decisions.

3. Social security and SSI funds

Older adults receiving social security benefits can use them for their independent living expenses. If the social security fund isn’t enough, seniors may use Supplemental Security Income (SSI). However, SSI has strict eligibility criteria, including income limits, disability, and age. In addition, it tends to have long waiting periods.

4. Private pay and personal funds

Private pay refers to paying for the facility out of one’s own pocket without relying on insurance or government assistance. Personal funds, on the other hand, may come from retirement savings, investments, or other sources of income. Both can be used towards senior living costs.

5. Selling assets

If you’re unsure how to pay for independent living, selling assets can be a great starting point. For example, selling off a second car, a vacation home, or even collectibles can provide much-needed cash flow. However, make sure to evaluate your assets and develop a plan to sell those that are no longer necessary and use the funds to cover your independent living costs.

How to pay for independent living

Final thoughts

After exploring the various options available for financing independent living, it’s clear that planning ahead is key. While government programs are great, they often come with many terms and conditions, whereas personal savings are handy but may put too much financial strain on seniors. So, it’s best to use a combination of funding sources while paying for independent living communities.

We hope this blog has provided helpful insights into the various ways to pay for independent living. As you begin to plan for your retirement and explore your options, remember to stay informed, ask questions, and seek guidance from trusted professionals. If you need more information on this topic, don’t hesitate to book a free consultation with BoomersHub!

Related articles:

- Paying for home care: what are the options?

- How to pay for assisted living?

- How to pay for nursing home?

- How to pay for memory care?

- What to Look for in Independent Living Facility: 8 Factors to Consider

FAQs

- What is the average cost of independent living in the US?

The average cost of independent living in the US varies depending on location, amenities, and services offered. Typically, independent living communities cost $1500 to $2500 per month. But luxury retirement communities can cost up to $6000-$10000 monthly.

- What is the cheapest way for a senior to live?

Some of the cheapest ways for a senior to live include:

- Downsizing to a smaller home or apartment that requires less maintenance and has lower utility costs.

- Moving to a more affordable area with lower housing costs and a lower cost of living.

- Applying for government assistance programs such as Medicaid, food stamps, and energy assistance.

- Sharing housing with a roommate or family member to split living expenses.

- Utilizing senior discounts and coupons for groceries, transportation, and entertainment.

- Participating in community programs and services that offer free or low-cost activities.

- Considering a reverse mortgage to access equity in their home for living expenses.

- What expenses are involved in independent living?

When considering a retirement community, it’s essential to understand the potential expenses. Some common costs associated with independent living facilities include:

- Admission fee

- One-time entrance fee

- Monthly rent/fee

- Personal services (e.g., spa, hygiene maintenance, etc.)

- Pet care

- Extra guest fee

- Any additional service or care (e.g., therapy sessions, parking services, etc.)