Article Contents

After a certain age, it’s not uncommon for older adults to require specialized care that can only be provided in a nursing home. While these facilities can provide excellent care, they often come with a hefty price tag, which can significantly burden seniors and their families. Thankfully, there are some financial assistance programs available for the elderly to help pay for long-term care.

This blog post will explore the different payment options and nursing home financial assistance to help you determine the best fit for your unique situation. So, if you’d like to learn more about how to pay for nursing home, keep reading!

Understanding the cost of nursing home care

Understanding the cost of nursing home care is important for anyone who may need to consider this option for themselves or a loved one.

The cost of nursing home care varies depending on several factors. The most common ones include the location of the facility, level of care needed, amenities offered, type of accommodation, and availability of financial aid. Typically, nursing homes cost more than other care facilities such as assisted living or in-home care. That is because nursing homes have a fixed facility fee and cost of providing skilled nursing or medical care.

What is nursing home financial assistance?

Nursing home financial assistance is the financial aid provided to individuals who are unable to pay for their nursing home care on their own. This assistance can come from a variety of sources, including government programs, private insurance, or personal savings and assets.

Qualifying for nursing home financial assistance programs can depend on a variety of factors, including age, income, and medical condition. For government programs like Medicaid, eligibility requirements can vary by state, but generally, seniors must meet specific income and asset requirements to qualify for assistance.

Other factors that may be considered are medical conditions and the level of care required. For example, if someone requires specialized medical care, they may be more likely to qualify for financial assistance. It’s recommended to speak to a financial advisor or elder law attorney to determine your eligibility for nursing home financial aid.

How to pay for nursing home?

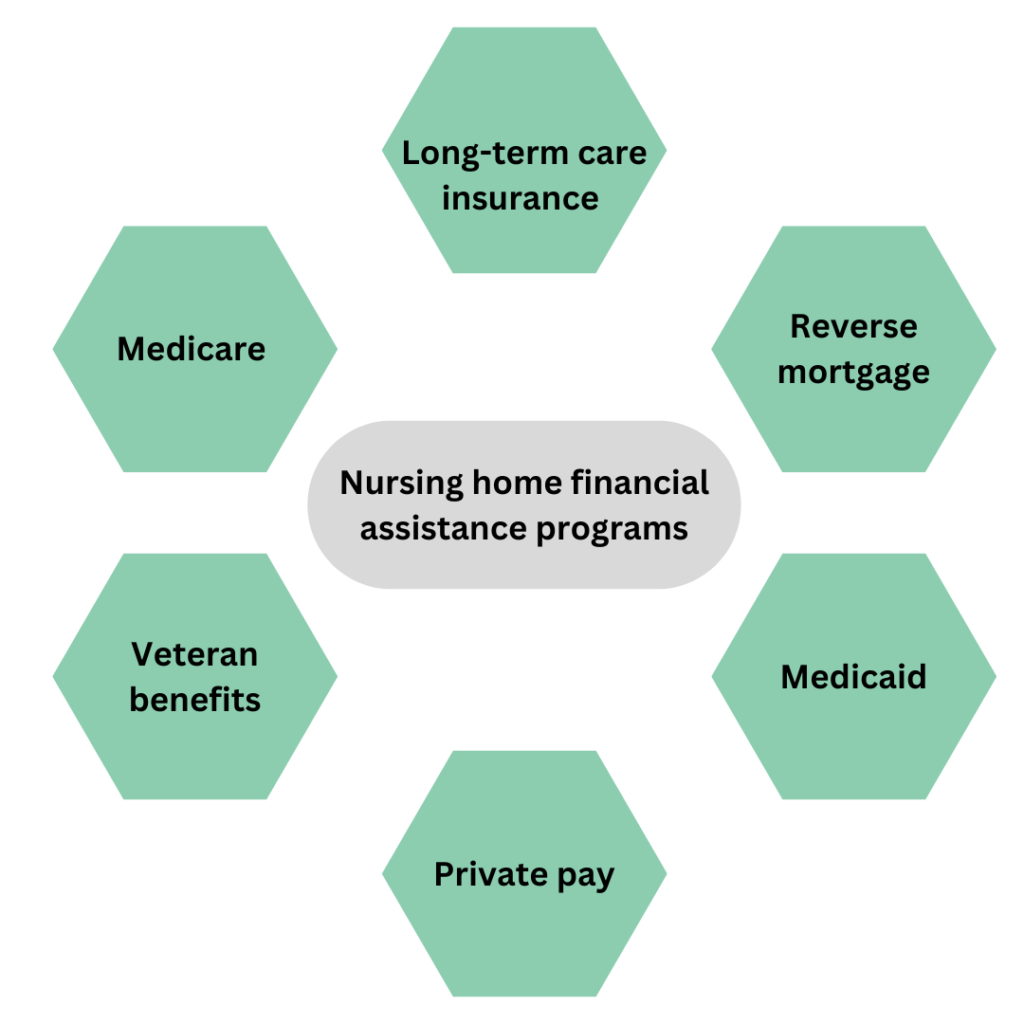

Most people pay for nursing home care using a combination of personal funds, insurance, and government programs. If you are thinking about how to pay for nursing home, here are some payment options to consider:

1. Long-term care insurance

Long-term care insurances can help cover the cost of nursing home care, as well as other types of long-term care, such as assisted living and home care. Premiums for private insurances can be expensive, but they may be worth it in the long run if you need long-term care.

2. Reverse mortgage

A reverse mortgage lets you borrow against the equity of your home, which can be used to pay for nursing home care. However, reverse mortgages can be complicated and may have high fees and interest rates, so it’s important to understand the risks and benefits before taking out a reverse mortgage.

3. Medicare

Medicare is a government program that offers health insurance to people over 65. It covers nursing home care for a limited time, typically up to 100 days. It’s important to note that Medicare does not cover the cost of long-term care in a nursing home, unless it is deemed medically necessary for a short-term period.

How to pay for nursing home

4. Medicaid

Medicaid is a federal and state joint program that provides assistance to people with limited income and assets to cover their healthcare costs. They have some eligibility requirements and a waiting period. Also, not all nursing homes accept Medicaid so it is good to do some research before selecting a facility.

5. Veteran benefits

Veterans and their families who require nursing home care may be eligible for benefits to cover the costs. Eligibility for these benefits depends on a variety of factors, including the veteran’s service history, income, and health status. The Department of Veterans Assistance offers a variety of resources to help veterans and their families navigate the application process and understand their options.

6. Private pay

Private pay is the best way to go when it comes to paying for nursing home. Having said that, it may not be the most convenient choice for the majority of seniors as they have a fixed income. So, it is best to use a combination of other financing options discussed earlier.

Final thoughts

To conclude, paying for nursing home care can be an intimidating task for many elderly individuals and families. But with proper planning and research, but it is very much possible to find a solution that suits you and your loved ones.

Some key takeaways from this blog include exploring government programs like Medicaid and veterans’ benefits, considering long-term care insurance, using personal savings, or a combination of multiple funding sources. It’s essential to start planning early and seek the advice of financial professionals to determine the best course of action for your unique situation. So, don’t wait – start planning today!

Related articles:

- 5 Ways to Protect Parent’s Assets from Nursing Homes

- Nursing home alternatives

- Paying for home care: what are the options?

- Using A&A Veteran Benefits for Senior Care Facilities

FAQs

- How to pay for nursing home with no money?

If someone needs long-term care in a nursing home but can’t afford it, they may feel overwhelmed and unsure of what to do. Fortunately, there are several options available to help pay for nursing home care, even if they have no money. Here are some suggestions:

- Check eligibility for Medicaid benefits

- Use life insurance

- Seek support from non-profit organizations

- Take help from family members

- Sell personal valuables or assets

- How to pay for nursing home care with social security?

Many older adults depend on social security benefits to cover their living expenses, including the cost of nursing home care. If the senior has a low income, limited assets, or disability, they may qualify for such benefits. Also, most seniors who qualify for social security benefits, also qualify for Medicaid benefits which can help cover the cost of nursing home care. But it is important to note that social security may not be enough to cover the entire cost of nursing home care.

- How to pay for nursing home during penalty period?

If you or a loved one is in a Medicaid penalty period, covering the cost of nursing home care can be challenging. However, there are several ways to pay for nursing home during penalty period. That includes:

- Reverse mortgage

- Personal savings

- Selling assets

- Bridge loans

- Charitable assistance

- Are nursing home expenses tax deductible?

Yes, nursing home expenses are tax deductible as far as they are considered medical expenses. For example, the expenses must be for medical care that was necessary for the patient’s health and well-being. But there are certain requirements that must be met in order to claim them as a deduction on your taxes. So, it is recommended to consult with a tax professional to navigate the complex tax laws.