Article Contents

Introduction

Many seniors consider turning 65 a massive milestone because they can be eligible for Medicare benefits. This federal benefit for seniors helps with healthcare expenses when you retire from work.

A large percentage of Medicare enrollees are seniors who are 65 or above. According to National Committee to Preserve Social Security & Medicare, around 52.6 million people aged 65 or more are covered by Medicare benefits. But not only that, another 8.7 million people aged 65 and younger with physical or mental disabilities have access to Medicare coverage.

Medicare is commonly misunderstood and neglected by seniors who can benefit from the goods and services it covers. This is primarily because of their difficulty in understanding the concept. Many seniors don’t completely understand different Medicare parts, advantages, coverage plans, and Medigap options.

We have prepared a complete guide for you to explain how Medicare works and how you can use it to receive healthcare benefits after you retire.

Medicare Basics: What Is Medicare Benefit?

Medicare is a federal health-insurance program for anyone aged 65 or more. Some younger people with disabilities can also claim Medicare benefits before turning 65. Also, anyone with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis of any age (ALS) can claim Medicare coverage.

This social insurance scheme was established under President Lyndon B. Johnson’s approval of the Social Security Act of 1965 to provide retirees and other qualified individuals with a fundamental availability of healthcare coverage. Payroll taxes are levied on both employees and employers to fund the program (self-employed individuals pay both portions of the tax). The original Medicare program covered hospital stays and other medical services, but it has since evolved to offer additional coverage options.

Medicare helps seniors to cover healthcare expenses but not all of them. Different categories of Medicare will allow you to pick your plan for healthcare coverage. Apart from Medicare Part A, Medicare Part B or Medicare Part D, you also have the opportunity to acquire Medicare Supplement Insurance or Medigap.

As already briefly mentioned above, Parts A, B, and D, are the three essential parts of Medicare. Hospital insurance is covered by Part A, whereas medical insurance is covered by Part B. And prescribed drug coverage is the area of Part D. There are two more options: Medicare Advantage, another name of Part C, and Medigap.

Different Medicare Parts You Should Know About

Medicare can be a complicated and confusing topic to get your head around. As a result, the federal authority has divided it into 4 basic parts. These 4-parts cover hospital care, visiting doctors, and prescribed drugs.

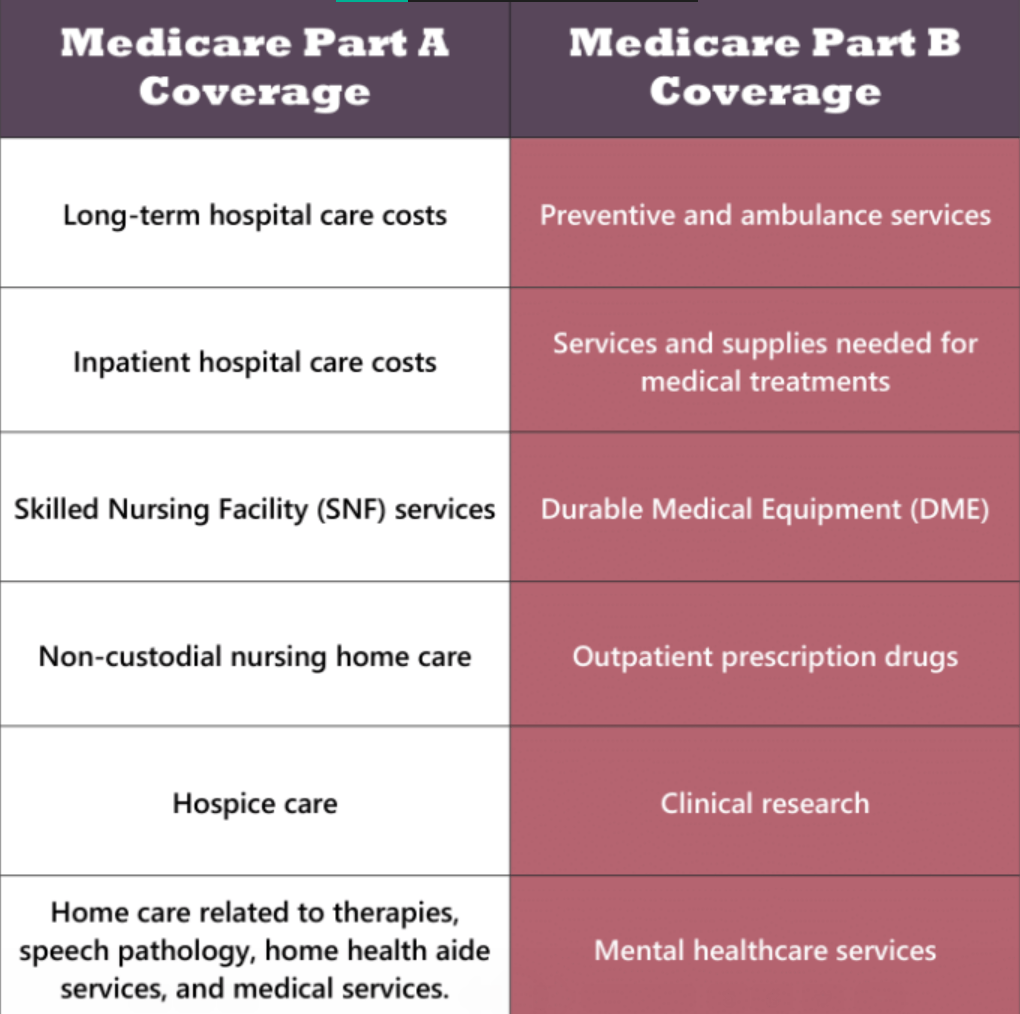

Part A: Hospital coverage

Part A of Medicare covers hospice care, Skilled Nursing Facilities (SNFs), and hospital stays after being diagnosed with a stroke, broken hip, or any other rehabilitation injuries. You can use Medicare benefits to pay for the first 60 days of hospital care. But there is some limitation. For instance, Medicare will not pay for you to stay in a private room.

The majority of seniors are not required to pay a premium for Medicare Part A. This is because you or your spouse has already contributed to the system by deducting Medicare taxes from your paycheck. However, it is not completely free of cost. In the following parts, we’ll go through it in further detail.

If you’re a U.S. citizen or permanent resident who has not worked long enough to be eligible for Medicare, you may be able to join the program by paying a Part A premium.

Part B: Doctor and outpatient services

Doctor visits, lab testing, diagnostic screenings, medical equipment, ambulance services, and other outpatient care are all covered under this section of Medicare. Part B, on the other hand, pays the total cost of preventive care services. It provides an approved amount directly to the providers who accept Medicare patients. You have to pay a premium every month to get Part B benefits.

Part D: Prescription drugs

This Medicare part pays for some of your selected and generic or branded prescription drugs according to your plan. Part D of Medicare has specific premium plans and annual deductibles. Even though the federal government retains control and oversight over Part D, the insurance is issued by private firms, who are ultimately responsible for determining the coverage rules. For example, plans differ on which drugs are covered and whether coverage is for a brand name or generic drug.

Medicare Advantage and Supplement Plans

Original Medicare is a government-run health-insurance program for anyone who meets certain criteria. It has undergone numerous alterations since its establishment in 1965, including the addition of Medicare Part C. And, if you still have Medicare gaps to fill, Medicare Supplement Plans or Medigap can be another option.

Medicare Advantage (Part C)

Medicare Advantage (MA) is an alternative to Original Medicare that covers health and drug coverage. A private company is mainly in charge of its approval. MA is a “bundled” plan that includes Part A, B, and D of the Original Medicare program. In most cases, you’ll need to see the specific doctors who are included in the plan’s network.

Originally, MA was named Medicare + Choice (M+C) in 2003, and since then, it has stayed as Medicare Part C. It is less expensive for seniors to afford.

Members of a Medicare Advantage Plan need to follow a specific set of rules. For example, you receive only location-specific services, and the coverage rules may vary based on your health conditions. However, part C of Medicare covers many of the services and medical supplies you’ll need to be healthy and handle any acute or chronic health concerns.

Some more Medicare Part C coverage includes the following:

- X-rays

- Lab tests

- Emergency care

- Visits to the doctor

- Cardiac rehabilitation

- Immunizations

- Surgery

- Splints and casts

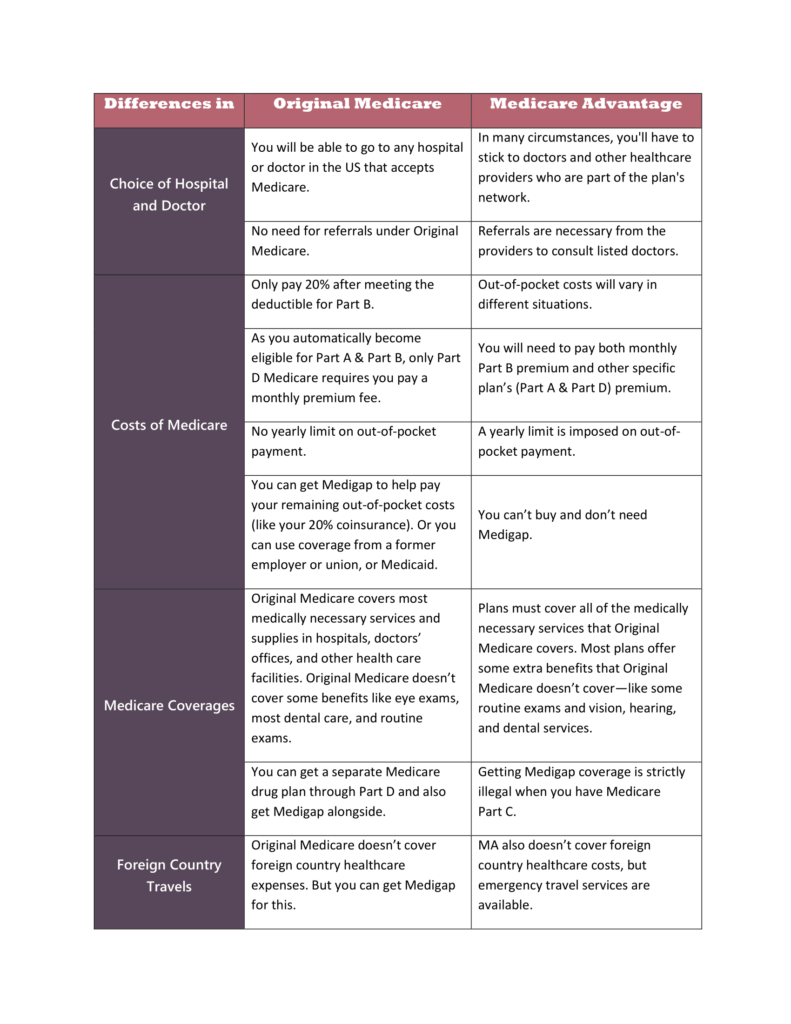

2 main ways to get Medicare: Original Medicare vs Medicare advantage

One of the most significant distinctions between Original Medicare and Medicare Part C is that private insurance firms offer MA plans. In contrast, Original Medicare is administered by the federal government. Check out more differences between original Medicare and Medicare advantage at a glance below:

Original Medicare vs Medicare Advantage (MA)

Medical Supplement Insurance (Medigap)

Medigap is also another name for Medicare Supplement Program. As the name suggests, this form of coverage is designed to fill in the gaps or act as a supplement to Original Medicare. Medigap plans are regulated by federal and state standards, but they are provided by private insurance firms.

One of the requirements of Medigap is that plans must be standardized across all insurance providers in a given state. This makes cost comparisons much simpler. In addition, prescription drug coverage is no longer provided by Medigap plans, as it was before 2006.

Medigap might also offer services that are not part of Original Medicare coverage. For example, covering foreign travel healthcare, hearing services, dental or vision services, and private nursing.

If you are already using an MA Plan, it’s completely illegal to get a Medigap policy unless you’re switching back to Original Medicare. If you have Medigap and join a Medicare Advantage Plan, you may want to drop Medigap. You can’t use Medigap to pay your Medicare Advantage Plan copayments, deductibles, and premiums because Medicare Advantage plans provide other protections that Medigap doesn’t.

5 Things Medicare Doesn’t Cover

The majority of older Americans’ medical requirements are covered by Medicare. But there are some things that Medicare does not cover. Here are a few needs that aren’t covered by the program.

Ophthalmology

While original Medicare covers ophthalmologic costs like laser eye surgery, it excludes routine eye exams, eyeglasses, and contact lenses. However, routine eye care and eyeglasses are covered by several Medicare Advantage plans.

Hearing tests and aids

Original Medicare and Medigap plans do not cover routine hearing checks or hearing aids but cover ear-related serious illnesses.

Dental services

Routine checks and major dental procedures, such as dentures and root canals, are not part of original Medicare or Medigap coverage.

Cosmetic surgery

Elective plastic surgery, such as facelifts and tummy tucks, is often not covered by Medicare. Only in the event of an accident will it finance cosmetic surgery.

Overseas medical care

Original Medicare and most MA plans offer no coverage for medical costs incurred outside the U.S.

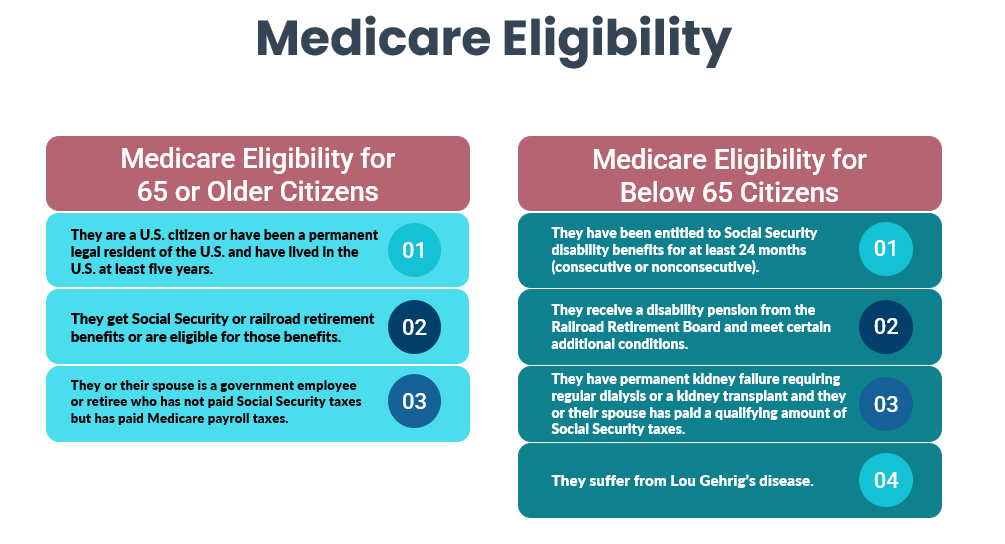

Medicare Eligibility & Requirements

Compared to understanding Medicare coverage and payment benefits, determining eligibility is rather simple. Most American seniors become eligible for Medicare at the age of 65. And seniors receiving Social Security benefits are automatically registered 90 days before their 65th birthday. They must, however, have lived in the United States for at least 5 years and be a citizen or legal permanent residents.

Americans under the age of 65 who fit the Social Security classification of disabled or have a diagnosis of end-stage renal illness may also be eligible for Medicare.

Automatic eligibility to part A & part B

If you already get Railroad Retirement Board (RRB) or Social Security benefits, you’ll receive Part A and Part B Medicare benefits on the first day of your birth month. Also, if your birthday falls on the month’s first day, Part A and B will begin on the first of the previous month.

Moreover, if you’re under 65 with a disability, you’ll be automatically enrolled in Parts A and B after receiving Social Security disability benefits or some RRB disability benefits for 2 full years.

Do you have Amyotrophic Lateral Sclerosis (ALS), often known as Lou Gehrig’s disease? Don’t worry, you’ll immediately get Parts A and B the month your Social Security disability benefits start.

You’ll get either a white, blue, or red Medicare card in the mail 3 months prior to your 65th birthday or on the 25th month of disability benefits if you’re automatically enrolled. And you won’t have to pay a premium for Part A (also known as “premium-free Part A”). The majority of seniors end up selecting a part B premium.

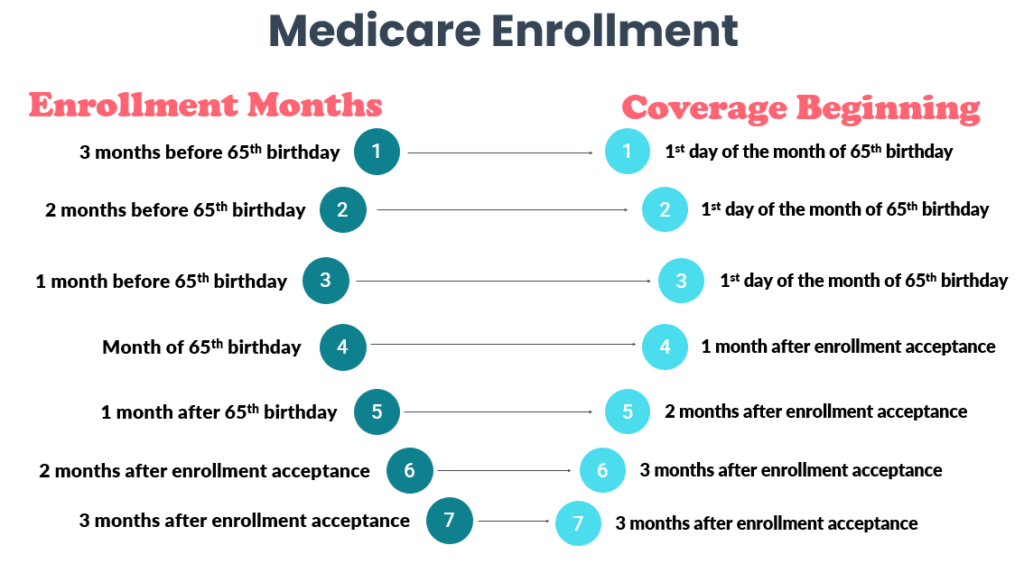

Medicare Enrolment Options for Seniors

Eligible seniors have a 7-month timeframe to enroll for Medicare, which begins three months before and ends three months after their 65th birthday. Those who have been receiving Social Security Disability Insurance (SSDI) for 24 months or who have become 65-years-old will be automatically enrolled in Medicare Parts A and B.

Seniors who are 65 but do not get Social Security retirement benefits should register for Medicare benefits as soon as possible.

How to enroll for Medicare benefits

You can submit Medicare enrollment applications online through the federal Social Security website. The application also allows you to apply in person at the local office.

When you visit the Social Security website, you will find a complete checklist of documents and other information. You will also be able to check your application status on the website.

Once you submit your application, the Centers for Medicare & Medicaid Services (CMS) will reach out to you through the mail. You will receive your Medicare card and a welcome packet there. The package will include further information and suggestions.

3 Medicare enrollment types and dates

If you are eligible for Medicare but currently not receiving Social Security retirement benefits, you can register for Medicare Parts A and B during one of the following three time periods.

Initial Enrollment Period (IEP)

The effective date of Medicare coverage is determined by the following date of enrollment:

Special Enrollment Period (SEP)

After the Initial Enrollment Period has concluded, anyone with qualifying special conditions can sign up for Medicare Parts A and B. The dates for SEP vary depending on the situation. The special circumstances can include changing living location, losing current coverage, changing current Medicare plan, and other special situations.

General Enrollment Period (GEP)

If you miss your IEP or SEP, you’ll have to wait until the following GEP, that runs from 1st January to 31st March every year. The coverage will begin on July 1 of the year you register. For each year you postpone enrolling in Medicare Part B, you might face a penalty in the form of greater payment.

Senior Care Coverage of Medicare

If a doctor certifies that a patient is homebound, Medicare Part A and/or Part B beneficiaries may be paid for a variety of in-home care services. In addition, they may be covered for nursing home care as well, but not for Assisted Living Facilities (ALFs). The primary categories of senior care are discussed in detail below, along with the extent to which Medicare covers them.

Medicare and assisted living

Medicare is a federal healthcare program that does not cover the cost of an ALF. However, Medicare may help pay for some assisted living costs for qualified senior citizens in senior living communities in certain instances.

How much does Medicare cover for assisted living?

It’s vital to understand that Medicare does not cover “custodial care,” such as most Activities of Daily Living (ADLs), and Instrumental Activities of daily living (IADLs). It instead covers only limited and medically essential skilled treatment for a sickness or injury. Therefore, only medical therapy will be covered by Medicare. For example, if you require long-term skilled care after being hospitalized and match the following criteria:

- First 20 days- 100% cost coverage

- For days 21 through 100- you cover some and rest is covered by Medicare

- No cost coverage after day 100

If residents of assisted living facilities have medical issues that are unlikely to improve, Medicare may be used to pay for continued long-term care services. You may have had a stroke, ALS, Parkinson’s disease, Multiple Sclerosis, or Alzheimer’s disease. For example. Hospice care may be covered by Medicare for assisted living home residents who have a terminal illness and are no longer pursuing a cure.

Medicare and nursing home

When medically essential, Medicare Part A covers skilled nursing care provided in Medicare certified institutions. As a result, if nursing home care is needed to diagnose or treat sickness, accident, disease, or other medical condition, it is covered. Custodial (non-medical) care, on the other hand, is never covered by Medicare therefore, a nursing home stay will not be paid if it is only the sort of care needed.

Medicare and Alzheimer’s care

Alzheimer’s disease is another form of dementia that affects memory, thinking, and behavior. It is a progressive disorder that causes memory loss as well as other cognitive losses such as trouble speaking or swallowing, disorientation, and difficulty completing daily chores such as dressing or using the restroom independently.

Inpatient and outpatient treatment, SNF services (including 24-hour supervision), hospice care, and respite care are all covered by Medicare for persons with dementia. The following is a list of what Medicare covers in terms of Alzheimer’s care:

- Inpatient hospital care

- Doctor visits

- Laboratory tests, screenings, and evaluations necessary for dementia diagnosis

- Only short-term rehab

- Physical therapy, speech therapy, mental health, other medical services.

- Hospice care for late stages of Alzheimer’s

Medicare and in-home health care

If medically essential, Medicare may cover in-home health care. It must also be part-time or intermittent, excluding full-time and long-term home care. Part A and/or Part B cover home health services such as skilled nursing care, medical social services, home health aide services, and physical and occupational therapies.

Non-medical care and services performed in the house, such as meal deliveries, are not covered by Medicare. In addition, homemaker services and personal care, such as support with housework and ADLs, may be covered only if they are offered in conjunction with other medically essential services.

Combine Medicare and Veterans Benefits

Veterans who served honorably in the Army, Navy, or Air Force may be eligible for VA benefits. For more flexibility and peace of mind, retirees with VA benefits are encouraged to enroll in Medicare. Medicare allows seniors to see doctors and facilities that are not affiliated with the VA, which might be helpful for specialty appointments. Prescription medicines are covered by Medicare Part D, which also allows seniors to fill their prescriptions at local pharmacies rather than through the VA’s mail-order service.

According to the official Medicare website, if a veteran does not sign up for Medicare when they are first eligible but wants to sign up later, they may be charged a penalty cost.

Medicare Costs and Premiums

Knowing how much each Medicare plan can cost is essential. Medicare contributes to the cost of your care, but it does not cover the entire cost. It is understood that you will provide a share of the expense, often known as “cost-sharing.”

4 types of Medicare cost-sharing

If you wish to participate in a Medicare plan, you have 4 options for cost-sharing.

Premium

This is a monthly and fixed amount to take part in a plan. It works differently for different Medicare parts:

- Medicare Part A- free of premium costs

- Medicare Part B- premiums are published each year

- MA premiums vary by plan

- Medicare Part D- premium plans will vary

Deductible

Deductible is an already set and fixed amount that you pay before the insurance begins to reimburse. This is how it works for each Medicare part:

- Medicare Part A- each year deductible is published for inpatient seniors

- Medicare Part B- standard deductible is published each year; applies to Part B covered services

- MA deductibles vary by plan

- Medicare Part D- deductibles vary by plan

Co-pay

A co-pay is another already set and fixed amount that you pay for every service. This is how co-pay works for every Medicare plan:

- Medicare Part A- free of co-pay costs

- Part B Medicare- co-pays are published each year

- Medicare Part D- co-pay plans will vary

Co-insurance

Finally, co-insurance includes a percentage of costs that you pay. This is how co-insurance works differently for each part:

- Medicare Part B- you pay only 20% of the total cost

- MA co-insurance vary by plan

- Medicare Part D- co-insurance plans will vary

Medicare Part A costs

If you or your spouse regularly paid Medicare taxes while working for a particular period of time, you normally don’t have to pay a monthly premium for Part A coverage. Part A is commonly referred to as “premium-free.”

You may be able to purchase Part A if you are not eligible for the premium-free version. In 2022, if you buy Part A, you’ll pay a monthly premium of $274 to $499.

Part A late penalties

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You’ll have to pay the higher premium for twice the number of years you could have had Part A but didn’t enroll.

Medicare Part B costs

In 2022, the regular Medicare Part B premium is $170.10. The majority of people pay the standard Part B premium.

Part B late penalties

If you don’t enroll for Part B when you first become eligible, you may receive a late enrollment penalty for the entire duration of your Part B coverage. Your monthly Part B premium may increase by 10% for each complete 12-month period during which you might have enrolled in Part B but did not. You normally don’t have to pay a late enrollment penalty if you sign up for Part B during a Special Enrollment Period.

How to Pay for Medicare Premiums

The out-of-pocket expenses of Medicare can pile up quickly. If you’re having trouble covering those costs, you may be eligible for federal and state aid. “Dual eligibility” allows you to use Medicaid to pay for Medicare premiums. There are, however, other options available.

The Qualified Medicare Beneficiary (QMB) program

This program helps you pay for deductibles, co-payments, Part A, and Part B premiums.

The Specified Low-Income Medicare Beneficiary (SLMB) program

This program helps you pay for only the Part B premiums. If you have a high income to qualify for the QMB program, you might qualify for this one.

The Qualified Disabled and Working Individuals (QDWI) program

This program only helps you pay for Part A premiums. This program is specifically designed for seniors under 65, who are still working with disabilities.

The Qualifying Individual (QI) program

This program only helps you pay for Part B premiums. If you have a high income for QMB and SLMB, you might qualify for QI.

Medicare and Covid-19

In the midst of Covid-19, your health and safety should be the top priorities. Many people on Medicare are at a higher risk of contracting Covid-19, so it’s critical to take the proper precautions to protect yourself and others. Several tests and services linked to Covid-19 are covered by Medicare. Consult your doctor or healthcare professional to determine which of these options is best for you:

- Covid-19 vaccinations for seniors

- Diagnosis and antibody tests to check Covid-19 presence

- Monoclonal antibody treatments

Medicare Assistance Programs Near You

Medicare has collaborated with state-specific health plans to provide demonstration plans for seniors who have both Medicare and Medicaid. As a result, the programs have been making it easier for seniors to access the services they require. Any or all of the following assistance programs may be available in your area:

State Pharmacy Assistance Program

Many states have State Pharmacy Assistance Programs that help seniors pay for prescription drugs based on their medical condition, age, and financial need.

Pharmaceutical Assistance Programs

These programs are also called Patient Assistance Programs. Many major drug companies offer assistance programs for seniors with Part D Medicare coverage.

Program of All-inclusive Care for the Elderly (PACE)

PACE is a Medicare and Medicaid program available in many states. It allows seniors needing nursing home-level of care to stay and live in the community.

Supplemental Security Income (SSI) benefits

SSI is a cash benefit Social Security for seniors with limited income and resources. Seniors who are aged 65 or older or have a disability can enjoy SSI benefits. These benefits are different from Social Security retirement benefits.

Know Your Medicare Rights

If you have Medicare or looking to enroll in Medicare plans, you have certain rights as below:

- Be treated with humbleness, respect, and dignity

- Have your personal and health information kept private

- Protection from discrimination

- Knowing about your treatment choices

- Getting sufficient information on Medicare and health care services

- Having access to doctors, specialists, and hospitals for medically necessary services

- Getting all the Medicare-related questions’ answers

- Right to appeal for Medicare decisions related to drugs and service coverage, unexpected coverage changes, and premium amounts.

Find More Resources from BoomersHub and Others

- Medicare and Medicaid Benefits

- Healthcare Coverage Options for Military Veterans

- Best Health Insurance Plans for Seniors

- Veterans Benefits Long Term Care

- Official US Government Medicare Handbook

- Medicare Benefit Policy Manual

- Medicare Part A, B, C & D Demographic

FAQs

How to find assisted living with Medicare?

Because they may not be able to offer the authorized medical treatments directly, not all assisted living facilities take Medicare. If you wish to utilize Medicare to cover your medical expenses while in an assisted living facility, make sure the facility is Medicare certified.

How to use Medicare to pay for assisted living?

You must show that the medical care was provided directly via the facility in order to use your Medicare benefits to cover assisted living fees. If your assisted living home accepts Medicare payments for medical care, it should offer an itemized list of services so you can see which healthcare costs are covered.

Does Medicare cover long-term care?

When medically essential, Medicare Part A covers skilled nursing care provided in Medicare certified institutions. As a result, if nursing home care is needed to diagnose or treat sickness, accident, disease, or other medical condition, it is covered. Custodial (non-medical) care, on the other hand, is never covered by Medicare. Therefore, a nursing home stay will not be paid if it is only the sort of care needed.

Does Medicare cover nursing homes for dementia patients?

Medicare covers only the first 100 days in a nursing home. After then, you must either cover all of your own expenditures or seek assistance from other sources, such as Medicaid and private health insurance.

Do I automatically get Medicare when I turn 65?

You can automatically enroll in Medicare Part A when you turn 65. If you or your spouse paid Medicare taxes for ten years or more, you will be automatically eligible for Medicare Part A and not have to pay a premium.

What does Medicare cover?

Medicare provides medically essential services and equipment in several venues, including your own home. However, Medicare and its multiple components are complex, with several exclusions. The pertinent section of this guide goes into greater depth about the topics covered.

When can I apply for Medicare benefits?

In general, you can sign up for Part A and Part B within three months before and after your 65th birthday. However, if you get disability benefits from Social Security or the Railroad Retirement Board, you may be eligible for Medicare sooner.

When do I get Medicare benefits?

Traditionally, after you reach the age of 65. This period is referred to as your Initial Enrollment Period. It will last for 7 months, within 3 months before and after you reach 65.

When do Medicare benefits start?

Your Medicare plan usually starts on the first day of your birth month. If your birthday is on the first of the month, your Medicare coverage will begin on the first of the prior month.

When do I need to sign up for Medicare benefits?

In general, we advise people to apply for Medicare three months before they turn 65. Then, if you currently receive Social Security, you will be registered in Medicare Parts A and B without having to fill out a separate application.

Do spouses get Medicare benefits?

Because Medicare is an individual insurance plan, spouses cannot be on the same program. If your spouse is qualified for Medicare, he or she can now enroll separately.

Can I receive Medicare without receiving social security benefits?

Even if you are unqualified for Social Security, you can join Medicare. You will just have to be 65 and a U.S. citizen or lawful permanent resident.

Can I have VA medical benefits and Medicare?

Although you can have both Medicare and Veterans Affairs (VA) benefits, they do not function together. Therefore, any care received at a VA facility is not covered by Medicare.