Article Contents

As people age, they often require additional assistance with everyday tasks, such as bathing, dressing, and preparing meals. While some seniors may opt to move into a nursing home or assisted living facility, many prefer to stay in their own homes for as long as possible. However, the cost of home care can be prohibitive for those on a fixed income.

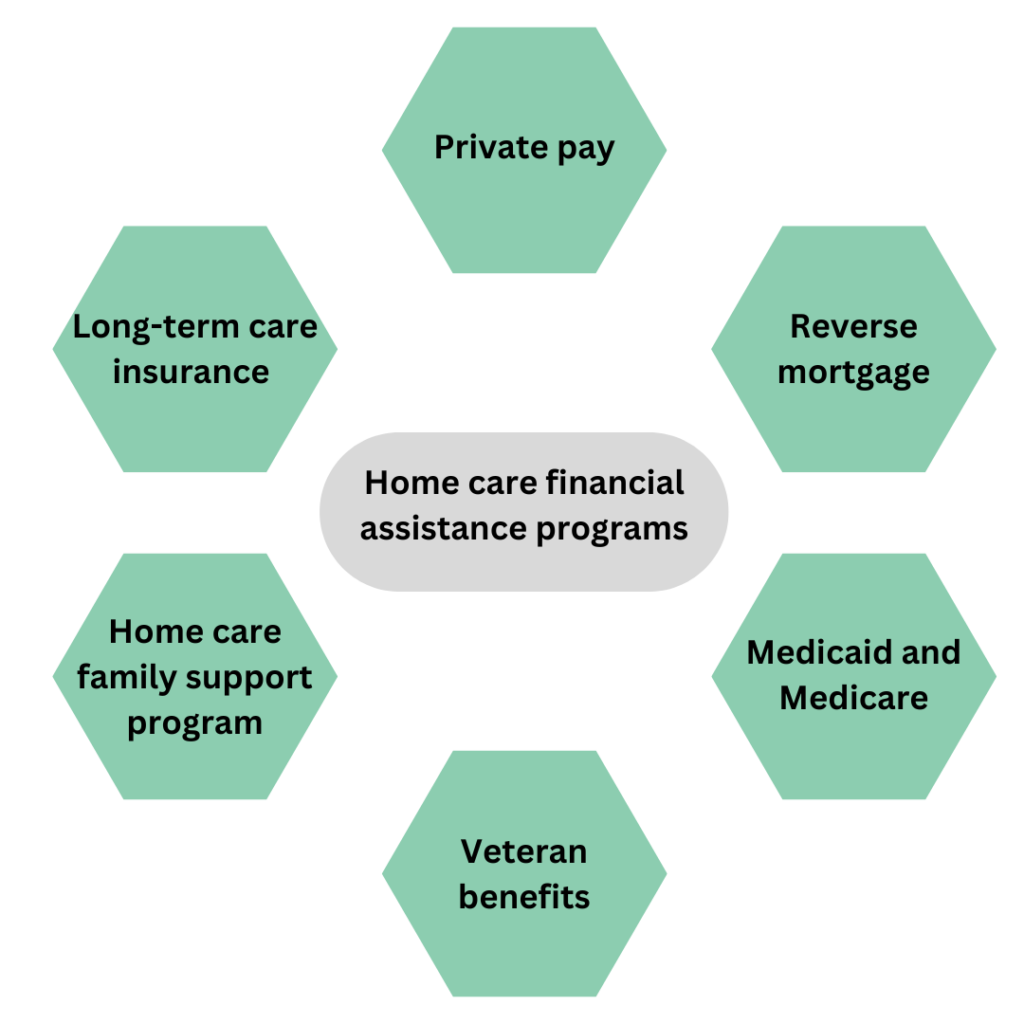

Fortunately, several financial assistance programs are available to help seniors pay for home care services. In this article, we will explore some of the most common options used while paying for home care.

What is the home care financial assistance program?

The Home care financial assistance program is an essential resource for individuals who require in-home care services but cannot afford the cost of care. These programs typically cover the cost of services such as personal care, homemaking, and respite care. The program may also cover the cost of medical equipment and supplies, as well as transportation to medical appointments.

To qualify for the program, individuals must meet specific eligibility requirements. These requirements typically include income and asset limits, as well as a requirement that the individual requires assistance with activities of daily living. These requirements vary by state.

Paying for home care: available options

There are several financial assistance programs available to help seniors pay for home care services. That includes:

1. Private Pay

Private pay refers to paying for home care services out-of-pocket, rather than through insurance or government programs. While this may seem daunting initially, private pay can be an excellent option for those who are ineligible for other forms of assistance or wish to have more control over their care.

Additionally, private pay can be more flexible than other forms of payment, as it allows clients to customize their care plan to fit their specific needs. Private pay can cover various home care services, including personal care, companionship, and skilled nursing.

2. Reverse mortgage

A reverse mortgage is a unique home loan that enables homeowners to convert a part of their home equity into cash without monthly payments to the lender. Instead, the loan repayment is made when the borrower either sells their home, permanently moves out, or passes away.

When borrowers take out a reverse mortgage, they can receive the loan proceeds in several ways. For example, they can opt for a lump sum payment, a line of credit, or monthly payments. Many seniors are looking for ways to pay for long-term care, and a reverse mortgage can be an attractive option.

3. Medicaid and Medicare benefits

Medicaid is a federal and state joint program that provides health insurance to low-income individuals and families, including seniors and people with disabilities. In addition to covering medical expenses, Medicaid also covers home care services. To qualify for Medicaid, you must meet specific income and asset requirements, which vary by state.

Medicare is another federal health insurance program that provides coverage to people 65 or older, as well as people with certain disabilities. While Medicare does not cover all home care services, it does cover some types of care. Specifically, Medicare covers home health care services, which trained medical professionals in your home provide.

Paying for home care

4. Veteran benefits

The department of veterans affairs offer several veteran benefits that can help cover the cost of homecare. The first benefit is the Aid and Attendance (A&A) benefit. This benefit provides financial assistance to veterans and their spouses who need help with ADLs or require the services of a caregiver. To qualify for the A&A benefit, you must meet specific criteria, such as being housebound or needing assistance with two or more ADLs.

Another benefit to consider is the Veterans Homemaker and Home Health Aide care. This program provides in-home care services by trained caregivers, including personal care, companionship, health assessment, and similar services. It can be a good alternative to a nursing home or respite care.

5. Home care and family support program

The US home care and family support programs typically work by providing financial assistance to qualified individuals and families. In some cases, the program may provide grants directly to the home care provider, while in other cases, the individual or family may receive a cash benefit to pay for care services themselves.

It’s important to note that home care and family support programs may have limited funding and may not be able to provide assistance to everyone who applies.

6. Long-term care insurance

Some long-term care insurance policies specifically cover home care services. These policies typically require the person to pay a monthly premium and may have a waiting period before benefits are activated. The specific services covered, and the amount of coverage vary by policy. Working with an insurance professional is recommended to help you understand your options and make the best decision for your individual needs.

Final thoughts

Some of the most common options for paying for home care include personal savings, private health insurance, government assistance programs, reverse mortgage, veterans benefits, and assistance from family members. It’s important to thoroughly research all of these options to determine which ones may apply to your situation.

We hope this post has provided some valuable insights into the different options available to pay for home care and has helped guide you in making an informed decision. Remember, seeking professional advice and support from a financial planner or elder law attorney can also be helpful.

Related articles:

- How to manage elderly parents’ finances?

- Medicare Flex Cards for Seniors: Complete Guide

- Best Health Insurance Plans for Seniors

- How Bridge Loan Works in Senior Living

FAQs

- How to get free home care for the elderly?

If you are looking to get free home care for the elderly, there are a few options to consider:

- Contact your local Area Agency on Aging to inquire about any available programs or resources for free home care.

- Check with your state’s Medicaid program to see if they offer any home care services for eligible seniors.

- Look into non-profit organizations that provide assistance to seniors, such as the National Council on Aging or the Alzheimer’s Association.

- Consider reaching out to local churches or community organizations for potential volunteers who may be able to provide some assistance.

- Explore options for home care grants or scholarships that may be available in your area.

- Can you get paid for taking care of a family member?

Yes, in some cases you can get paid for taking care of a family member. However, this depends on a few factors such as:

- The state you live in

- The type of care your family member needs

- The source of funding for the care

- Your long-term care insurance policies