You’ve spent the prime years of your fast-paced life working towards a secure future. Now that your long-awaited retirement is here, where will you spend it? Choosing your retirement destination is about honoring your budget, health, safety, and lifestyle.

Ohio is a famous state to consider for retirement, renowned for its culture, history, and scenic beauty. In our recent article, we learned about retirement homes in Ohio . But what if you crave a place away from the busy commotion of the city?

Gain an understanding of some of the popular towns in Ohio that are ideal for retirement. See if one of these destinations is a place you could call home.

Is Ohio a good place to retire?

Known as the “Heart of it All” state, Ohio offers various options based on your retirement needs. Here’s what you can expect:

- Outdoor enthusiasts can enjoy national parks and hiking trails.

- Retirees fond of history will be delighted to find well-known cultural and sports museums like the Rock and Roll Hall of Fame and the Pro Football Hall of Fame.

- Small towns in Ohio can offer new retirees a refreshing (and scenic) take on lifestyle.

Here are more reasons why Ohio can be a good retirement pick in the Midwest:

- Ohio’s cost of living is at least 10% lower than the national average.

- Healthcare and everyday expenditures are more affordable. However, the availability of specialized health care varies based on region.

- The tax situation is friendly and won’t break your wallet.

You may find this article helpful:

What is the retirement age in Ohio?

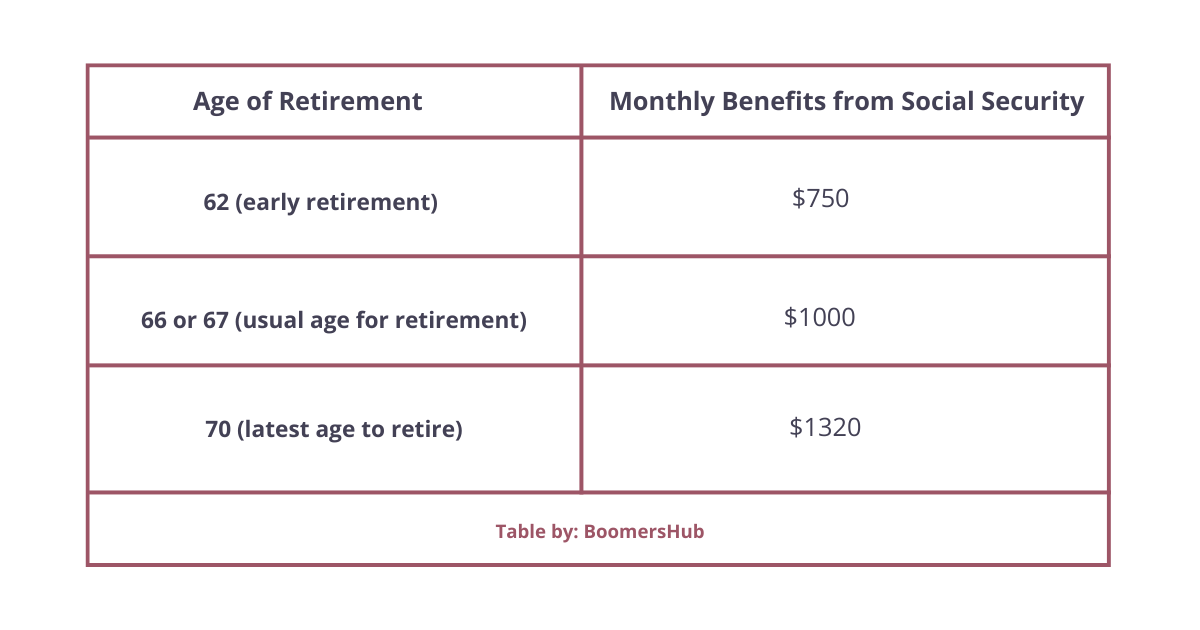

While the retirement age can vary depending on a specific benefit program or personal situation, in Ohio, the average age is 63. The national average is 62, but considering social security, it is viewed as an early retirement entailing reduced benefits. You can get increased benefits if you delay your retirement to age 70.

For the Ohio Public Employees Retirement System (OPERS), the average retirement age ranges from 60 to 65, depending on the plan and years of service. (Please note with the upcoming US Elections in November, the national retirement age may be subject to change in 2025).

Ultimately, the decision about when you need to retire is yours. While being considerate of your health, your finances are the key players that can guide you in making this choice. With a solid financial plan, you can quickly retire when the time is right.

Look for a town in close proximity to a big city

Small towns near big cities such as Columbus or Cleveland can offer several advantages, especially for retirees with potential health issues. Here’s why you should look for small towns that are closest to larger cities:

- A small town may offer access to primary healthcare at most, but being able to travel to the closest big city easily for specialized medical needs is essential.

- Big cities offer more amenities, such as shopping centers, entertainment options, and cultural events, when you need a change of pace from the tranquility of your small-town neighborhood.

- In towns, living costs are more affordable than in the big cities.

- The sense of community is also more robust. Living in a town close to a big city lets you have the best of both worlds!

Why is a small community better for retirement?

Living in a smaller town is a rather refreshing experience. Compared to big cities, there is less pollution and a better attachment to nature. Towns such as Yellow Springs are close to hiking trails and nature preserves, allowing you to walk, birdwatch, and even bike.

In addition, a smaller community can allow you to know people of various age groups and form lasting bonds of friendship! But most importantly.

1. You get a small-town feel

A fresh start in a small town can make you feel like you’re in your hallmark movie. You get to pick an affordable home with the perfect garden or porch surrounded by similar beautiful houses in the serene, close-knit neighborhood. Furthermore, housing options are more accessible and budget-friendly to customize.

Small towns allow you to pause and spend time on self-discovery. There are so many things on your bucket list to try! There is an array of workshops and community classes for you to explore. You can finally live that laid-back lifestyle that you’ve always dreamt of.

2. Smaller communities offer a tight knit retirement

The beauty of being part of smaller communities is the sense of family. When you live in a small town:

- You are part of a close-knit group where people look out for each other.

- There is a community spirit that will act as your support network. It can fill any social void that you may feel in your retirement.

- You get a chance to create lasting memories with people of various ages.

Small towns such as Yellow Springs and German Village have regular festivals, gatherings, and community events that can foster comradeship with fellow residents. There are even community gatherings at local restaurants, game nights, and book-reading clubs that can be exciting! There are regional initiatives that you can participate in, be it mentoring or volunteering, which gives you the chance to leave a meaningful impact in your community.

3. Retirement can be affordable

But the selling point of small-town retirement is the cost! While the cost of living in Ohio is lower than the national average, retiring in a small town is even more affordable.

Category | Small Towns (Average) | Big Cities (Average) |

Monthly expenditure | $2,500 – $3,000 | $3,500 – $4,500 |

Median Home Price | $150,000 – $200,000 | $250,000 – $350,000 |

Monthly Rent | $600 – $1,000 | $1,200 – $2,000 |

Groceries (monthly) | $300 – $400 | $400 – $500 |

Medical Care (monthly) | $400 – $600 | $500 – $700 |

Utilities (monthly) | $150 – $200 | $200 – $250 |

Transportation (monthly) | $100 – $150 | $150 – $200 |

Amenities | Basic amenities, fewer cultural and entertainment options | Extensive amenities, more cultural and entertainment options |

Population | Typically < 20,000 | Typically > 200,000 |

Proximity to Hospitals | Typically 20-40 miles from major city hospitals (e.g., Cleveland Clinic, Ohio State University Wexner Medical Center) | Numerous hospitals within city limits |

Note: Some other factors such as population, proximity to hospitals and so on, have also been considered to draw a contrast between small-town life and living in a big city.

7 Best towns to retire in Ohio on a budget

Irrespective of the colorful prospects of a small town, retirement eventually boils down to factors like costs, care support with activities of daily living and primarily, senior living care.

For those seeking senior living options like assisted living or nursing homes, here is a list of our recommended seven best towns for retiring on a budget!

1. Yellow Springs

(Population: 3,731)

Yellow Springs is famous for its art community and various outdoor activities. For hiking, be sure to visit the 1000-acre Glen Helen Nature Preserve. The crime rate is low, too. There are frequent art openings and festivals, with one of the most anticipated events being the Yellow Springs Street Fair.

If you like restaurants, the neighborhood has plenty of options, including the well-known Calypso Grill and Smokehouse Restaurant.

2. Marion

(Population: 36,837)

Marion promises nostalgia with its peaceful parks, museums, and landmarks. You will feel that town vibe here while lingering between a town and a city. The Wyandot Popcorn Museum, the Buckeye Telephone Museum, and the Huber Machinery Museum are top locations to visit.

This town has an annual Marion Popcorn Festival, and if you love tradition, you can see why this town is called the “Popcorn Capital of the World.” Thus, you can enjoy all the extensive city amenities here while observing golden hours in a town-like atmosphere.

3. Berlin

(Population: 1,164)

Berlin is a beautiful town with friendly, down-to-earth residents who pay homage to the Amish way of life. There are antique stores and Amish tourist attractions. One of the safest towns to choose for retirement since the crime index is 10 points less than the national average. The community is amicable and caring towards its residing seniors. You get to live in a town where restaurants offer home-style cooked dishes and peaceful treading around the locale.

4. Cambridge

(Population: 10,347)

Famous for its Victorian-era buildings and unique shops, Cambridge has a small-town feel with a cultural heritage. You can visit the famous Guernsey County Courthouse, known for its popular holiday light show. Learn about the history of glassware by visiting the National Museum of Cambridge Glass. The sense of community is strong, and you will be enchanted by the beauty of such a well-known town.

5. Mason

(Population: 34,792)

Mason offers its residents an exciting range of entertainment options, from three extensive golf courses to an amusement Park called Kings Island. Housing is cheaper, offering a safe and comfortable neighborhood for retirees to settle down.

6. Lima

(Population: 37,882)

This charming small town is ideal for retirees, especially since the cost of living here is 13% lower than the national average. The housing cost is also around 45% less than the average. For farm lovers, this town is a real treat, where you can spend your free time at Allen County Farm Park. You can also hear the call of birds from Lippincott Bird Sanctuary!

7. Ashtabula

(Population: 18,017)

This mid-sized town is built on the shores of Lake Erie and the mouth of the Ashtabula River, which promises spectacular natural scenery during your retirement. There are several aquatic recreational activities, such as boating and canoeing. A trip along the Western Reserve Greenway Trail will be a treat for those who prefer drier but equally stimulating activities.

This town is secure with low crime rates and affordable living (around 9% lower than the national average). Cleveland is just an hour’s drive away if you ever crave the city or need quality medical care!

Retiring in Ohio: Pros and cons you need to know

Here are some pros about retiring in Ohio:

- There are numerous world-class theme parks in Ohio, such as Kings Islands in Mason and Cedar Point.

- You can find incredible food in almost any town in Ohio, such as the Amish County pies in Berlin or Ohio City pretzels.

- You can experience the beauty of all four seasons during your retirement.

- For music lovers, Cleveland is a heaven for rock and roll and other music attractions.

Here are some cons to consider:

- The winters may be difficult to bear (Unless you enjoy breathtaking snow-covered scenery).

- The summers can be equally challenging, being hot and humid.

Public transportation in some towns may be limited. - It rains more than usual.

- Cities like Columbus have a very high pollen count from April to May, which may be a problem for those with allergies.

Final thoughts

By weighing all factors, such as housing cost, monthly medical expenses, closeness to big city hospitals, and so on, retirees can choose their dream destination to settle in as their home.

It is also essential to consider critical attributes necessary for the lifestyle you wish to live, e.g., significant landmarks, the culture of the towns, and the community. Here’s to a fantastic adventure in one of the most beautiful towns in Ohio!

Articles you may be interested in:

FAQs

What are the pros and cons of moving to Columbus, Ohio?

The pros of moving to Columbus, Ohio, are the following:

- There is a diverse population.

- The economy in Columbus is thriving, and the job market is robust.

- The cost of living is affordable.

- Arts and Culture are celebrated.

- There is a variety of outdoor activities.

- The sports culture is strongly followed.

The cons are these:

- There is frequent traffic.

- The weather conditions can be severe.

- Education in public schools needs to be improved.

- There are higher tax rates than significant cities.

- Bad air quality during the summer.

- Rapid population growth.

- Healthcare may be expensive.

Does Columbus Ohio have a big city feel to it?

Columbus is the largest city in Ohio. You can feel the big city vibe from its dense urban atmosphere, active nightlife, and various cultural activities. There are plentiful entertainment activities and metropolitan amenities that further boost Columbus’s features.

Nevertheless, this city remains accessible to people of all ages, with a strong sense of community.

Is Ohio a good retirement state?

Ohio is a tax-friendly state for retirees. It offers some of the best healthcare options and is home to some of the friendliest people you will encounter! Ohio ranks in the top half of states for the best sales tax, income tax, and real estate options.

What is the best part of Ohio to live in?

Depending on your budget and lifestyle preferences, if you wish to prioritize safety, you can choose Broadview Heights, the safest city in Ohio. Cleveland is a wise option for accessibility to top healthcare. Cincinnati is often the most preferred location due to its tolerable weather, excellent medical facilities, and low cost of living. Akron is also one of the popular choices for retirees and the birthplace of NBA superstar LeBron James.

How much does it cost to retire in Ohio?

Considering the average estimate, saving around $800,000 – $925,000 (on average) can help you retire easily in Ohio. However, be sure to consult a financial expert before making any decisions.