Article Contents

Introduction

Are you thinking about including a Trust in your Estate Plan? Indeed, it is a wise decision. Even if you’ve already started planning or have a Will in place, Trusts can provide an extra layer of security for your family, loved ones, and legacy after you’re gone. In addition, setting up a Trust may be the smartest thing you have ever done if you have assets worth more than $160,000, own a home, or have dependents.

Many people find the subject of estate planning intimidating, stressful, and perplexing. You may not want to think about the inevitable. Still, you can get through the process and feel confident in your decisions with our assistance. Our comprehensive overview of the many types of trusts available will assist you in getting started.

What Is a Trust?

A trust is an estate planning that is the legal binding agreement between the trustee and the trustor. Trustors are also known by other names, such as settlor or grantor. The person responsible for creating the trust and transferring assets into it is known as the trustor. The trustee is the person or entity in charge of administering the assets in accordance with the trustor’s desires. The trustor is frequently also the trustee, or one of several trustees, until their end of time, of course.

A trust, like a will, can have beneficiaries. Your spouse, children, other family members, or even close friends may be among the beneficiaries. A charitable organization can also be named as a trust beneficiary. According to your (the settlor’s) instructions, those nominated as trust beneficiaries are eligible to receive assets from the trust according to your (the settlor’s) instructions to the trustee.

Parties in a Trust

- Grantor/Settlor: The person who creates and funds the trust.

- Trustee: The person or institution responsible for managing the trust assets.

- Beneficiary: The person(s) who will receive the benefits of the trust.

4 Common Types of Trusts

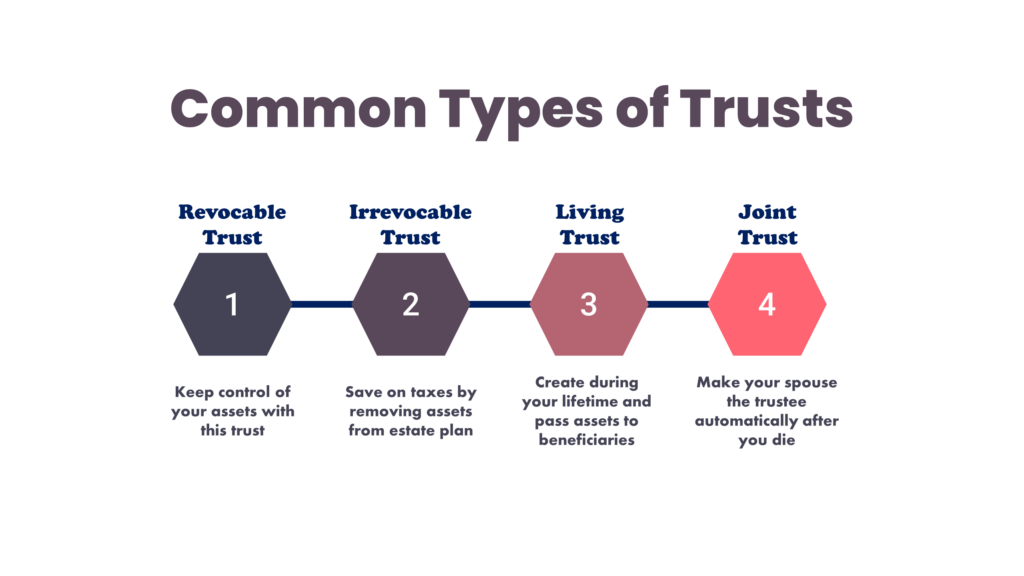

Although there are different types of Trusts to choose from, you don’t have to worry about choosing the right one for your needs and circumstances. Instead, we’ve included the four most prevalent types of trusts below and detailed descriptions of each, so you know precisely what you’re looking for.

1. Revocable trust

Revocable living trusts or revocable trusts allow you to keep control of your assets during your lifetime. If necessary, you can amend or dissolve a revocable trust. In addition, you can “revoke” them, which is why they’re called “revocable” trusts. If you divorce or acquire new assets, for example, you may need to change the trust’s rules to reflect the repercussions of such occurrences.

A revocable trust gives you more options because the transfer of assets and the parameters you’ve provided for their handling don’t become permanent until you die away. For example, you can nominate yourself as a trustee or co-trustee with a revocable trust. Along with that, you can appoint a successor trustee if you become unable to run the trust.

Probate is not required for a revocable trust. This means that the trust’s assets are distributed to the beneficiaries without going through probate court. In comparison to a will, this allows for more privacy. Furthermore, creditors may find it more challenging to seize assets kept under a revocable trust to satisfy existing debts.

2. Irrevocable trust

You can’t edit or modify an irrevocable trust once it’s been established. You can’t go back and change your mind about transferring real estate or other assets to the trust. So why create one in the first place, given that it means less flexibility?

An irrevocable trust can shield some assets from estate and gift taxes by removing them from your estate. This could be interesting if you have a substantial estate and want to reduce your tax bill on those assets.

3. Living Trusts

Living Trust is another form of a revocable trust. It’s a trust that you set up during your lifetime and will benefit your designated beneficiaries after you pass away. While a Living Trust can save your loved one’s money by avoiding the time-consuming and often costly probate process, it is not an excellent way to secure your assets while you are still alive. Although assets held in a Living Trust will be more challenging to access, they may nonetheless fall into the hands of creditors during your lifetime. So, it’s certainly not foolproof.

4. Joint Trusts

When two people decide to create a Trust together, a Joint Trust may be ideal. For a married pair, this would be a reasonable sort of Trust. During the couple’s lifetime, both partners have the authority to keep control of the assets. When one of them passes away, the surviving partner becomes a Trustee.

Cost of Setting up a Trust

The cost of setting up a trust in the USA can vary widely, depending on the state, the complexity of the trust, whether attorneys are involved, and other related matters. Typically, the average cost ranges from $1,000 to $5,000.

Here is the approx. cost of setting up a trust in different states:

- Average cost of setting up a trust in Texas is between $750 and $2,500.

- Average cost of setting up a trust in California is between $1000 and $2,500.

- Average cost of setting up a trust in Florida is between $1000 and $3,000.

- Average cost of setting up a trust in Arizona is between $1000 and $1,500.

- Average cost of setting up a trust in Massachusetts is between $1000 and $5,000.

- Average cost of setting up a trust in Illinois is between $1000 and $3,000.

- Average cost of setting up a trust in Ohio is between $1000 and $3,000.

- Average cost of setting up a trust in New Jersey is between $1000 and $3,000.

- Average cost of setting up a trust in Pennsylvania is between $1000 and $3,000.

- Average cost of setting up a trust in North Carolina is between $1000 and $3,000.

What Are the Pros and Cons of a Trust?

Here is an overview of the pros and cons of a trust:

Pros of a Trust:

- Avoidance of Probate: Assets held in a trust can bypass the probate process, which can be time-consuming and expensive. This allows for faster distribution of assets to beneficiaries.

- Privacy: Trusts are generally not public records, unlike wills, providing more privacy for the grantor and beneficiaries.

- Flexibility: Trusts can be structured with various provisions and rules to meet the specific needs and wishes of the grantor.

- Continuous Asset Management: A trust can provide for the continuous management and oversight of assets, even after the grantor’s death or incapacitation.

- Asset Protection: Trusts can help protect assets from creditors, lawsuits, and other claims.

- Tax Benefits: Certain types of trusts, such as irrevocable trusts, can provide tax advantages, such as reducing estate taxes.

- Incapacity Planning: Trusts can help ensure that assets are managed according to the grantor’s wishes in the event of their incapacity.

Cons of a Trust:

- Cost: Establishing and maintaining a trust can be more expensive than a simple will, especially for smaller estates.

- Complexity: Trusts can be more complex to set up and administer than a will, which may require the assistance of an attorney.

- Inflexibility: Once a trust is established, it can be difficult to make changes, especially if it is irrevocable.

- Ongoing Maintenance: Trusts require regular administration and management, which can be time-consuming and may involve ongoing legal and accounting fees.

- Lack of Familiarity: Some individuals may be less familiar with trusts compared to wills, which can make the planning process more challenging.

- Potential for Disputes: The complexity of trusts can sometimes lead to disputes among beneficiaries or between beneficiaries and the trustee.

- Loss of Control: Depending on the type of trust, the grantor may relinquish some control over the assets placed in the trust.

11 Different Types of Trusts Seniors Can Look into

Apart from these four major trusts, there are 11 more kinds of trusts that you can look into.

1. Testamentary Trusts

A Testamentary Trust, “Will Trust” or a “Trust Under Will,” is established within a Will and does not take effect until your death. Your Last Will and Testament specify the creation and settlement of the actual Trust at the appropriate moment. Testamentary Trusts aren’t actually Living Trusts because they aren’t genuinely a living document until you die (thus the name). Note that Testamentary Trusts must go through probate, and you will lose part of the privacy protection that other Trusts provide – these are two of the key benefits of Trusts in the first place.

2. Charitable Trusts

A Nonprofit Trust is precisely what you can think of initially. It is a trust established to benefit a charitable organization. This type of Irrevocable Trust provides tax advantages while still producing revenue. You nominate a Trustee when you create a Charitable Trust. They can build a steady income stream by investing (or liquidating and reinvesting).

Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs) are the two forms of charitable trusts (CRTs). The key distinction between the two is how the Trusts’ profits are distributed. For example, a CLT would first distribute a certain amount of income to a designated charity organization, with the remainder going to beneficiaries or remaining in the Trust. On the other hand, A CRT pays out first to the beneficiaries, with the remaining going to the charity.

3. Marital Trusts (“A” Trust)

Another common name of a Marital Trust is “A” trust. One spouse can create a marital trust for the benefit of the other. When one spouse passes away, the trust assets and any income generated by the assets are passed on to the surviving spouse. The surviving spouse would avoid paying estate taxes on such assets during their lifetime if they used a marital trust. However, any leftover trust assets that eventually fall to the surviving spouse’s heirs would be subject to estate taxes.

4. Bypass Trusts (“B” or Credit Shelter Trusts)

To lower the estate tax burden on their descendants, married couples can set up a bypass or credit shelter trust (also known as a “B” trust). This irrevocable trust transfers assets from one spouse to another after the first spouse dies. The assets are not directly held by the surviving spouse, however. Instead of going into the spouse’s estate, the trustee controls them. When the surviving spouse passes away, any leftover assets are tax-free to the beneficiaries.

5. Special Needs Trusts

Special Needs Trusts benefit mentally or physically challenged individuals under 65 who will require lifelong care. These trusts are a method to help financially without endangering the benefits of government assistance (Medicaid or SSI). There are three sorts of Special Needs Trusts. Depending on your circumstances and the type of need, you will be able to choose the most suitable one.

6. Asset Protection Trusts

Another approach to protecting your assets from creditors is to use an Asset Protection Trust. If you’re concerned about judgments or any other threat to your estate, this is the most ironclad alternative aside from an Irrevocable Trust. However, they might be pricey to set up.

7. Blind Trusts

A blind trust is also a Living Trust. The beneficiaries have no prior knowledge or information about any of the Trust’s assets. Whomever you name as trustee will have complete control over the Trust’s assets and distribution in the end. If you predict any conflicts of interest, blind trusts are frequently a suitable option.

8. Insurance Trusts

An Insurance Trust is yet another form of irrevocable trust. It has only one asset: an insurance policy. It’s a method of avoiding estate tax on any money withdrawn from a policy after your death. People will use an Insurance Trust to ensure that a more significant portion of their wealth goes to their beneficiaries.

9. Spendthrift Trusts

In a spendthrift trust, the beneficiary has no direct access to the assets or money contained inside. Instead, the Trustee or Trustees you choose have broad authority to distribute Trust funds to beneficiaries in any amount they consider proper. A Spendthrift Trust is commonly used when a beneficiary is young or has a history of financial irresponsibility.

10. QTIP Trusts

The full form of QTIP Trust is Qualified Terminable Interest Property Trusts. They’re employed to ensure that the Trust’s income is distributed to a surviving spouse. The remaining money remains in the original Trust until the second spouse passes away. The rest of the money after that would go to the beneficiaries.

11. Credit Shelter Trust

A Credit Shelter Trust is a type of trust that can avoid or considerably decrease estate taxes when passing assets to the beneficiaries. If you are wealthy and have a lot of assets, this trust is for you. One of the most significant advantages is the right it gives to surviving spouses once the first spouse dies. Seniors can use the revenue and the Trust’s principle to meet needs such as those for educational or medical expenses. Furthermore, assets left after the surviving spouse’s death can be transferred to the final recipients without triggering estate taxes.

How Having a Trust Can Help Seniors?

Trusts can be highly beneficial for seniors. Let’s look at a straightforward scenario. One of the most common types of trusts is irrevocable trusts. With this trust, you can transfer the control of your money to a trustee. This allows that trustee to be eligible for Medicaid benefits as long as you follow the “penalty period” timeline of transferring the money within 5 years of your trustee applying for Medicaid.

Moreover, you can also gain tax advantages from having a trust. Whatever assets you include in your trust, they get step-up benefits. As a result, your heir can substantially save a lot of money on taxes.

What Are the Tax Advantages of a Trust?

The specific tax benefits depend on the type of trust and how it is structured. It’s important to work with a qualified estate planning attorney to ensure a trust is set up properly to maximize the tax advantages.

Here are some of the significant advantages of a trust:

- Trusts can help reduce estate taxes by removing assets from the grantor’s taxable estate

- Income generated by trust assets is taxed at the trust level, which may be at a lower rate than the grantor’s personal income tax rate

- Trusts can provide asset protection from creditors and lawsuits

- Certain types of trusts, like charitable trusts, can provide income tax deductions

Conclusion

You can place your trust in Trusts even after you’ve gone. For this reason, it’s so tightly linked to estate planning. It will be easier to organize your estate if you understand the different types of trusts.

Contact us if you want to know more about trust or trust and senior living. Our professional team is always there to help you.

FAQs

-

Is a living trust revocable or irrevocable?

Revocable living trusts are flexible and can be changed during the grantor’s lifetime. Irrevocable trusts provide more estate planning benefits but cannot be modified once established.