Article Contents

Introduction

The initial stages of the estate planning process can seem stressful and challenging. There are several legal and technical aspects to consider. And it is not always straightforward about where to begin or what to begin with. But, as a senior, seeking support and gathering information beforehand is ideal. Hence, BoomersHub brings a brief guide on wills for seniors and the types of wills that you should know about.

It is critical to get a good understanding of wills before it’s too late. We understand that once you retire and wish to live out your life peacefully, wills, trusts, and other legal papers should not be a headache. Yet, as you want to safeguard your legacy and care for your loved ones’ future, it is paramount to be well-prepared.

To put it precisely, every adult requires to have a will. Understanding the many types of wills is the first step towards it. We’ll break them down for you to make an informed decision and write a will tailored to your needs. But before that, let’s gather a brief understanding of wills.

What Is a Will?

The last will is a legal document that outlines your desires for property distribution. Without a will, your estate will be distributed according to state law. This may not reflect your wishes and could lead to disputes among your heirs. A will can help ensure that your property is distributed as you want and that your minor children are taken care of according to your wishes.

A will is legitimate if it complies with legal requirements, which usually, but not always, include witnessing it. The benefit of having a will set up by an attorney stems from his understanding of the law.

Another name for a will is a testament. It is a legal document that allows a property owner to dispose of his possessions after death. The written instrument in which the testator’s dispositions are expressed is also referred to as the testator’s dispositions. On the other hand, a nuncupative will or an oral will is only valid in some jurisdictions. Still, it is generally sustained if it is regarded as a deathbed gift.

5 Major Benefits of Having a Will

Having a Will comes with numerous advantages. In fact, not having one is a considerable risk and a bad idea. Below are five benefits of having a will for seniors:

1. Proper distribution of possessions

If you pass away without a Will, the law dictates how your estate will be distributed. Although certain property is by default distributed to a spouse or children, exact distribution depends on the value of property. A Will is the only way to make sure that your properties are distributed exactly as you want.

Your will can specify what should happen to your online financial accounts and assets, social media accounts, computer or cloud files and photographs, and access to all of the above granted to family and friends.

2. Dictating care for minor children

If you have minor children, having a will is very crucial. Then, before they reach adulthood, you can appoint a legal guardian in their place.

3. Minimize estate tax payments

You can reduce the amount of taxes you pay while distributing your estate by leaving certain items in trust or giving them away to your children, spouse, or any other family member.

4. Fulfill funeral wishes

You can include any burial or cremation preparations, religious ceremonies, etc., in your will. Although such terms are not legally binding, stating your funeral and burial choices may make it easier for your loved ones to carry them out, lessening the burden of the task.

5. Reducing stress on executors

Without having to go through a court process, your executor(s) will be able to obtain the assets nearly instantly. On the other hand, court processing can take months, leaving family members without access to critical income flow when they need it most (e.g., to pay for living expenses, funeral arrangements, etc.).

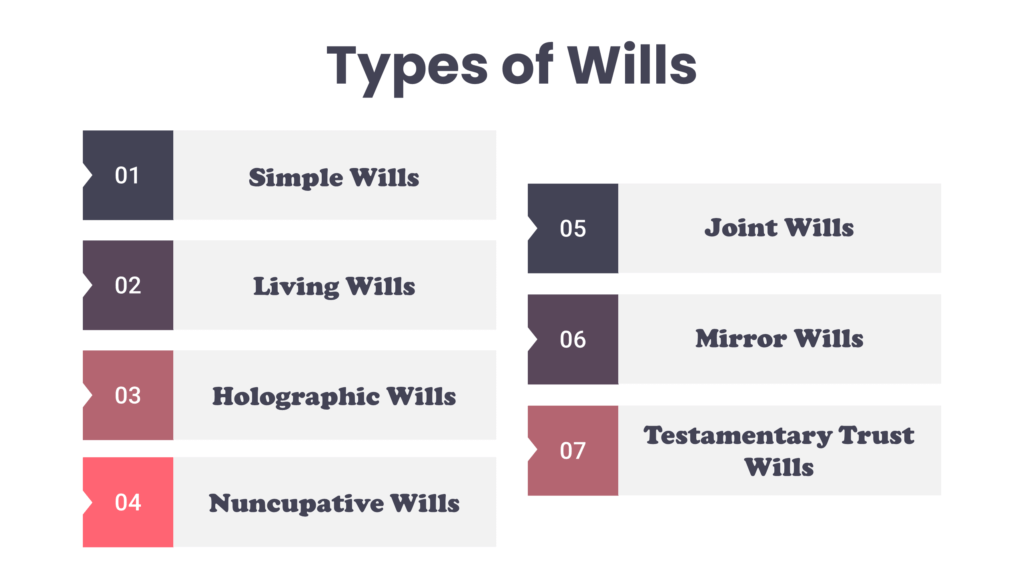

7 Different Types of Wills

Everyone has some idea about written or living wills. There are quite a few kinds of wills that you can look into. We have compiled a total of 7 different types of wills for seniors.

1. Simple wills

A basic last will and testament are known as a simple will. It specifies whom you wish to inherit your property and assets when you pass away. First, you must say that the paper is your will and reflects your final intentions in a simple will. You will also need two or three adult witnesses. Then you can name the people or organizations who will inherit your property when you pass away. Beneficiaries refer to these heirs.

You can designate who will carry out your intentions in a simple will. The executor of your will is this individual. Furthermore, if you have little children or pets, you can name guardians to look after them.

Don’t undervalue the strength of a simple will! Despite its name, this will cover a lot of ground, and it’s sufficient for most people who don’t have complicated estates.

2. Living wills

A living will allows you to designate which medical procedures and medications you want, which treatments and medications you don’t want, and whether or not you wish to be an organ donor. This allows you to control your healthcare rather than burden your loved ones with potentially painful or difficult decisions.

“Advance Healthcare Directives” are another name for a living will. Despite its name, a living will is not the same as a will. Instead, it’s a legal document that outlines your end-of-life care wishes if you’re unable to communicate them. For example, if you are seriously injured and rendered unconscious, your living will take effect.

3. Holographic wills

Holographic wills are straightforward despite their difficult name. This style of will is handwritten and signed, often without the presence of witnesses.

Handwriting a will may appear to be the simplest method of drafting a will. However, most estate attorneys advise against creating a holographic will because they are not accepted in all jurisdictions in the United States. Holographic wills must meet specific standards in order to be upheld in court in jurisdictions that allow them, and these requirements differ by state. The executor, for example, may need to show that the deceased person intended for the document to be used as a will. In addition, family members frequently contest the legality of these wills due to the lack of witnesses.

4. Nuncupative wills

Spoken wills are also known as nuncupative wills. A “death-bed will” or “oral will” is another name for this form of will. They are mostly preferred when the testator believes they will die soon and wishes to express their wishes before they do.

State-by-state requirements for drafting a legally valid nuncupative will vary greatly. For example, some states do not accept them as legal documents. Other conditions, such as the number of witnesses or seniors’ wishes after being uttered, may apply to those who do.

5. Joint wills

Joint wills are created by couples to protect their partner’s financial stability. This will, unlike mirror wills, is a single document that the couple creates and signs together. The single will incorporate the wishes of both partners into one document. It cannot be altered without both partners’ consent. This means that if one of the partners dies, the surviving partner cannot modify the terms of the joint will or determine who would inherit their property.

Most estate attorneys recommend drafting mirror wills instead of a joint will since a joint will cannot be amended after one partner dies.

6. Mirror wills

Wills made by a married couple or domestic partners are known as mirror wills. The mirror will term means that the content of one spouse will “mirror” the content of the other spouse’s will. They all designate the same people and organizations as secondary beneficiaries. This allows the pair to prioritize ensuring their partner’s financial security before passing the estate on to their successors.

7. Testamentary Trust Will

A testamentary trust will is written inside a will to direct the disposition of your assets after your death. Will trusts or trusts under wills are other names for testamentary trust wills. This type of Trust is unique because it is not in-effect until after your death. If you need to provide long-term care for beneficiaries, Testamentary Trust Wills are a viable alternative.

Which Type of Will Is Right for You?

The type of will you create is determined by a number of things, including your financial situation, whether or not you own a business, and whether or not you possess the property passed down through the generations. You can find the proper will for your situation from all the many forms of wills available.

For instance, you can consider creating a testamentary trust will before you pass away. This will comes in effect only after the death of the creator. As a result, this type of will is highly beneficial for long-term care. Suppose you create a testamentary will during your lifetime and name your spouse or wife as a beneficiary after you pass away. The assets you included in the trust will be countable if you or your spouse tries to apply for Medicaid benefits. When you pass away, your trust will be forwarded to your wife to use the benefits during her lifetime. Any asset you included in the trust will again be countable and can be spent for your wife’s care until she becomes eligible for Medicaid benefits.

One of the most important and loving things you can do for your family is creating a will. Why? Because, at the end of the day, everyone wants to know that the people and things they care about will be looked after, regardless of what occurs. You can be 100% certain of it if you have a will in place. Now that you’ve learned about their many characteristics, you may finish your will and cross it off your to-do list!

When to Update Will Over Time?

It’s critical to regularly review and update wills as life circumstances change over time. Not doing so can result in wills not accurately reflecting your current wishes and may lead to unintended consequences for your loved ones.

Some common life events that should prompt you to update your wills include:

1. Marriage, Divorce, or New Children/Grandchildren

Major family changes like getting married, divorced, or having new children or grandchildren can significantly impact how you want your assets distributed. You’ll want to ensure your will properly names your current spouse and/or any new descendants as beneficiaries.

2. Significant Changes in Assets or Financial Situation

If your overall net worth, property holdings, investments, or other assets change dramatically, you may need to revise your will to account for these differences. This is especially important if the changes affect the value of specific bequests you’ve outlined.

3. Moving to a New State

Each state has its own unique laws governing wills and estate planning. If you move to a new state, it’s wise to have an attorney review your existing will to ensure it still complies with the inheritance and probate requirements in your new jurisdiction. Certain will provisions may need to be updated.

Making updates to your will doesn’t have to be an arduous process. Many estate planning attorneys recommend reviewing your will every 3-5 years, or whenever a major life event occurs. By staying proactive, you can have peace of mind knowing your final wishes will be properly carried out.

Conclusion

If you are ready to create a will, it is important to understand the different types of wills and choose the one that best fits your needs. Each type of will has its own benefits, so be sure to research each option before making a final decision. Working with an attorney can also help you ensure that your will is executed properly and that your wishes are carried out after your death.

So, have you decided on which type of will is best for you?

FAQs

Why should I have a will?

A will is a written document that acts as your legal representative when you pass away. It lets you specify how you want your property and assets dispersed, select a guardian for any minor children if you die before they reach adulthood, and leave specific instructions such as funeral preparations.

What type of will is the best for me?

For the majority of elders, a living will may be the best solution. But, despite its namesake, a Living Will can do much more than a standard Last Will and Testament. A Living Will, also known as an Advance Healthcare Directive, is useful for planning your end-of-life care and expressing your preferences for future medical care.

What is the most common will for seniors?

The most frequent will type is the simple will. This type of will specifies where and how you want to allocate your assets once you pass away. This is the simplest form of will that many American seniors prefer.

What does a will cover?

A will allows you to direct the distribution of your assets, such as bank accounts, real estate, and valued things. For example, if you have investments or own your business, a will can specify who and when those assets will be distributed.

What is the difference between wills and trusts?

The fees and delays of probate do not apply to trust assets. Information regarding the trust assets is kept private unless the trust is questioned. When a will is probated, however, it becomes public information.

What happens if I don’t have a will?

You have died “intestate” if you die without a will. When this happens, the state’s intestacy laws will determine how your assets are dispersed after you die. This includes any bank accounts, stocks, real estate, and other assets you had at the time of your death.

What Are the Alternatives to a Will?

While a last will and testament is the most common estate planning document, several alternatives can serve similar purposes:

- Revocable Living Trust – This allows you to transfer ownership of your assets into a trust that you control during your lifetime. Assets in the trust avoid probate upon your death.

- Beneficiary Designations – Life insurance policies, retirement accounts, and other financial products allow you to name direct beneficiaries.

- Joint Ownership – Holding property like real estate or bank accounts jointly with rights of survivorship means it passes directly to the surviving owner.

- Intestacy: When someone passes away without a valid last will and testament, their estate is considered to be “intestate.” In this situation, state intestacy laws dictate how the deceased person’s assets and property will be distributed, rather than the individual’s own wishes.

Who is the best executor of a Will?

The executor of a will is the person responsible for administering your estate after you pass away. Some key qualities to look for in an executor include:

- Trustworthiness and integrity

- Organizational and financial skills

- Availability to devote the necessary time

- Impartiality in dealing with beneficiaries

- Familiarity with your assets and wishes

Many people choose a spouse, adult child, other family member, or trusted friend as their executor. Professional executors like banks or attorneys can also be named, often for more complex estates.

What is a last Will and testament?

A last will and testament is the legal document that outlines your final wishes for how your assets and property should be distributed after your death. It names your chosen executor, guardians for any minor children, and the beneficiaries who will inherit your estate.

The will goes through the probate process after your passing to ensure your instructions are properly carried out. Having a valid, up-to-date will can help avoid family conflicts and ensure your assets are passed on according to your intentions.